What are the customs duties and taxes?

VAT

The customs value plus the duty paid value is subject to import VAT. This is set at 5%. (including the local taxes).

The Japanese government agreed on December 30, 2011, to raise the general VAT rate to 8% in 2014 and 10% in 2015. This was due to the massive public debt and the comparatively low general VAT rate. This judgment is very contentious, and its passage through parliament is uncertain.

The Excise Tax in Japan

A variety of items in Japan are subject to excise charges (Law No 37 on the collection of excise duties on imports, 1955). These are cigarettes, gasoline, and alcoholic beverages.

The following tariffs are in effect under the Liquor Tax Act (No. 6, 1953):

JPY 220,000/kl for beer with an alcohol content of less than 20%; JPY 80,000/kl for wine; JPY 370,000/kl for whisky, cognac, and other alcoholic beverages with an alcohol content of 37% or more: JPY 370,000/kl + JPY 10,000/kl for each percentage above 37%; JPY 120,000/kl for liquor with an alcohol content of less than 13%: JPY 120,000/kl

How can you obtain a tax break?

In GSP nations, you can obtain a partial or entire exemption (including Malaysia). The rest will be determined by the kind of what you import and the country of origin.

GSP

The Generalized System of Preferences (GSP) is a trade preference program established by numerous industrialized nations within the framework of the World Trade Organization for commodities from developing countries. It does not apply to the customs charges of impoverished nations, but solely to their exports; it is a system of help for developing countries to assist them in their commerce. As a result, several Malaysian items are listed.

Products that are overly competitive (textiles, for example) will not benefit from GSP.

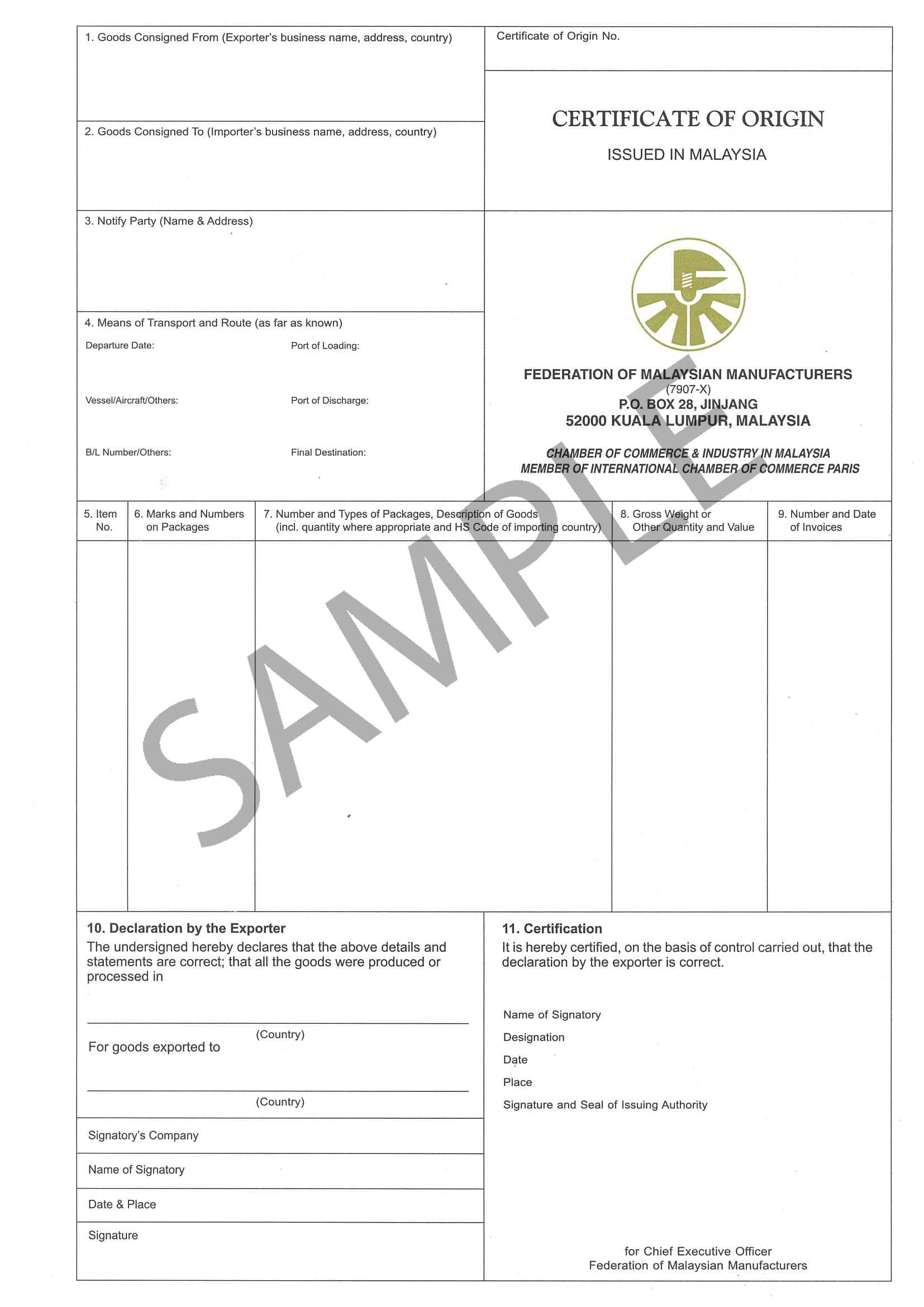

Obtain a Certificate of Origin to present to Japanese customs in order to profit from GSP.

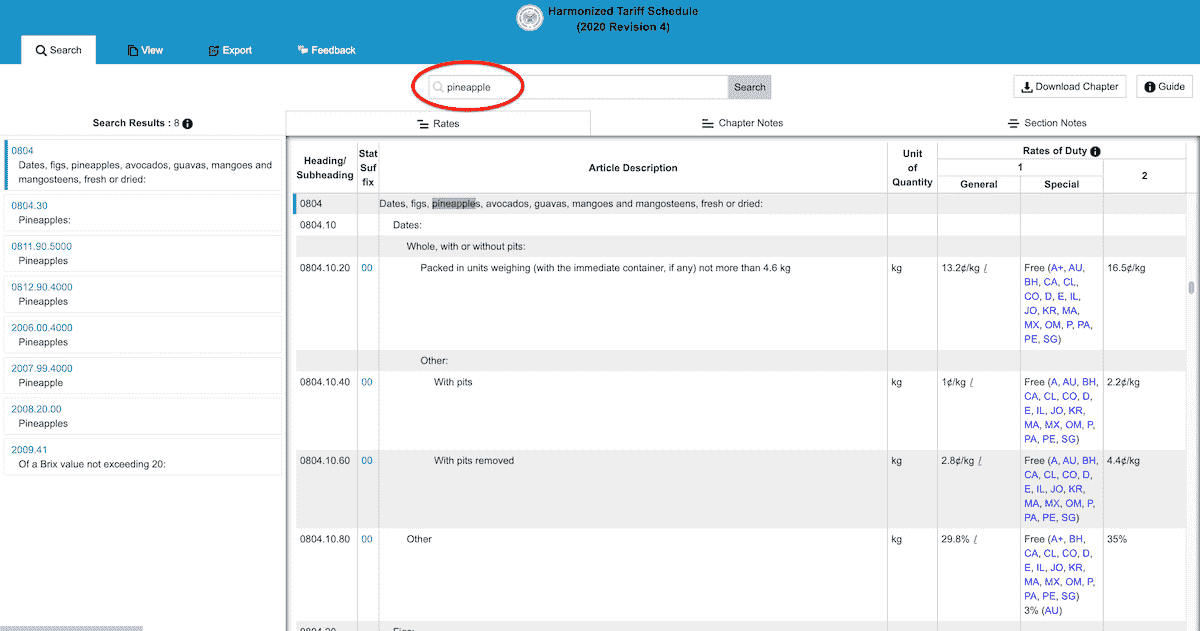

Japan Custom

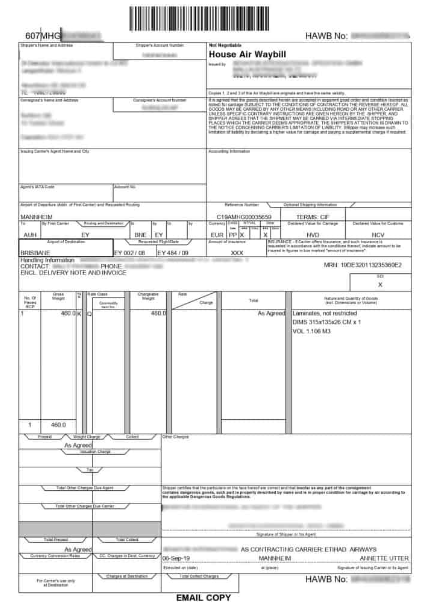

Japan Custom Original invoice

Original invoice