Believe it or not, shipping goods from Malaysia to India isn't as hard as trying to eat spaghetti with a spoon! Yet, the complexities of understanding rates, transit times and nitty-gritty customs regulations can make it appear daunting.

This comprehensive guide is your gateway to mastering the process. We explore varying types of freight options, dissect customs clearance procedures, and dive into areas such as duties and taxes. Moreover, unique advice tailored for businesses is sprinkled throughout the guide to help you make informed decisions.

If the process still feels overwhelming, let DocShipper handle it for you! As an international freight forwarder that takes care of every step of the shipping process, we are committed to turning your logistical challenges into successful, hassle-free experiences.

Table of Contents

Which are the different modes of transportation between Malaysia and India?

From the spicy cuisine of India to the bustling markets of Malaysia, transporting goods between these two dynamic nations can feel like maneuvering a ship through choppy seas.

The distance is vast, and land routes are nearly impossible due to presenting geographical constraints. But fear not, for the sea and sky offer effective ways to bridge this gap.

Whether it's flying above the clouds or sailing the Andaman Sea, your delivery options are tied to balancing cost, time, and volume. Imagine choosing between a speedy falcon or a slow yet brawny elephant - it all depends on your specific shipping needs.

How can DocShipper help?

Shipping goods between Malaysia and India? Let DocShipper simplify the process for you. Our team can handle every step, from logistics to customs clearance. Need a helping hand? We're here for you. Just a call away for free advice. Contact us for a free estimate in less than 24 hours. Let's make your shipping hassle-free.

DocShipper Tip: Sea freight might be the best solution for you if:

- You're dealing with hefty quantities or oversized goods. Sea transport is your go-to for maximizing space without stretching your budget.

- Time sensitivity isn't a concern for your shipment. Ocean freight is known for its leisurely pace, especially when compared to the speed of air or rail.

- Your supply chain connects key international harbors. This positions you to take full advantage of a wide-reaching network of ocean trade routes.

Sea freight between Malaysia and India

A brisk walk through the thriving trade lanes connecting Malaysia and India could leave you awestruck. These Asian powerhouses, linked by centuries-long trade relationships, rely heavily on the ocean route, with hubs like Port Klang in Malaysia and Nhava Sheva in India serving as pivotal cargo ports. Picture an enormous 20-ton container filled to the brim with electronics or raw materials. The most affordable way to transport such hefty goods? The high seas, of course.

But it's not all smooth sailing, is it? Figuring out this marine maze can be daunting for shippers, akin to decoding a complex recipe in a foreign language. Miss one ingredient and you may face costly shipping mistakes, lengthy paperwork, and even customs clearance delays. Fear not. This section unfolds the secrets to bypass these hellish hurdles and delivers a blueprint on how to streamline your oceanic leaps between Malaysia and India, ensuring your container doesn't just bob around the ocean aimlessly. Even on the unpredictable waters, you can be the captain of your own ship.

Main shipping ports in Malaysia

Port of Klang

Location and Volume: Located in the Selangor district, it's Malaysia's busiest port and ranks 12th globally in terms of shipping volume. Handling around 14.06 million TEUs in 2023, it caters to shippers in the domestic and international markets.

Key Trading Partners and Strategic Importance: The Port of Klang has the US, China, Singapore, Japan, and India as top trading partners and serves as a significant link to global trade lanes.

Context for Businesses: Are you seeking efficient connections to major markets? The Port of Klang offers high-frequency services to over 500 ports globally, making it ideal for businesses aiming for expansive market reach.

Port of Tanjung Pelepas

Location and Volume: Located in Johor, adjacent to the eastern mouth of the Straits of Malacca, this port handled 10.48 million TEUs in 2023, establishing its importance in the regional trade.

Key Trading Partners and Strategic Importance: Tanjung Pelepas connects Malaysia with prominent trading locations like China, Hong Kong, and the US.

Context for Businesses: If your strategy involves serving Asia-Pacific markets, consider utilizing the Port of Tanjung Pelepas for its strategic location, making it ideal for transshipping goods to the region.

Port of Johor (Pasir Gudang)

Location and Volume: The Johor Port, also known as Pasir Gudang, is located in the southern part of Peninsular Malaysia and moved approximately 1.45 million TEUs per annum.

Key Trading Partners and Strategic Importance: This port's main trading partners include Indonesia, Thailand, and China. It's strategically important for the distribution of palm oil, rubber, and cocoa.

Context for Businesses: If your business mainly deals with goods like palm oil or rubber, Johor Port's specialized terminals could provide practical shipping solutions.

Penang Port

Location and Volume: Situated at the northern part of Peninsular Malaysia, Penang Port is a medium-sized facility that moved approximately 2.2 million metric tonnes in 2022.

Key Trading Partners and Strategic Importance: The port primarily trades with China along with other key partners such as Singapore, the US, and Japan.

Context for Businesses: Looking to ship electronics or electronic-related goods? Penang Port, dubbed as the 'Silicon Valley of the East', has strong infrastructural support for these types of cargo.

Port of Bintulu

Location and Volume: Based in Sarawak, Eastern Malaysia, Bintulu is a smaller port but critical for its handling of liquefied natural gas. In 2023, it handled 12.443 million tonnes.

Key Trading Partners and Strategic Importance: The port's main trading partners include Japan, Korea, and Taiwan, primarily in the LNG sector.

Context for Businesses: If your business transports LNG or other similar goods, the Port of Bintulu should be a primary consideration due to its specialized LNG facilities.

Port of Kuantan

Location and Volume: Located on the East Coast of Peninsular Malaysia, Port Kuantan is a smaller but emerging port that handled over 24 million tons of cargo in 2022.

Key Trading Partners and Strategic Importance: Key trading partners include China, due to its participation in the ambitious Belt and Road Initiative that promotes regional connectivity.

Context for Businesses: If you're seeking entry into the Chinese markets via a less-congested port, Kuantan Port is worth considering. It is set to become an increasingly important player in the regional logistics landscape.

Main shipping ports in India

Port of Nhava Sheva

Location and Volume: Positioned on the Arabian Sea in the west of India, the Port of Nhava Sheva is crucial for business because it serves as the chief port in Mumbai, with an annual shipping volume exceeding 5 million TEU.

Key Trading Partners and Strategic Importance: The port's primary trading partners encompass countries in North America, Asia, and the Middle East. Its strategic importance lies in its status as the largest container port in India.

Context for Businesses: If your business concentrates on North American, Asian, or Middle Eastern markets, Nhava Sheva holds significant potential. Its size and facilities make it suitable for high-volume shipping.

Location and Volume: Located north of Mumbai on the Gulf of Kutch, Kandla Port is significant for being the busiest port for major goods, handling over 100 million tonnes of cargo annually.

Key Trading Partners and Strategic Importance: Kandla Port's key trading partners are established in the USA, UAE, China, and Singapore. It's strategically indispensable due to its utility for bulk cargo shipments.

Context for Businesses: If your enterprise deals with bulk cargo, particularly targeting markets in the USA, UAE, Singapore or China, Kandla Port constitutes an efficient part of your logistics with its specialized facilities.

Location and Volume: Situated in Goa on the west coast of India, Mormugao Port is critical for its iron ore exporting capabilities, with a considerable annual handling exceeding 50 million tonnes of cargo.

Key Trading Partners and Strategic Importance: The port primarily trades with Japan, while also servicing other countries. Its strategic importance stems from its dominance in iron ore exports.

Context for Businesses: If your organization exports iron ore or is operating in markets around Japan, the Mormugao Port is an effective choice for your shipping venture due to its specialized export functions.

Location and Volume: Located on the east coast of India, the Port of Visakhapatnam plays a vital role in handling a variety of goods, with an annual shipping volume of around 65 million tonnes.

Key Trading Partners and Strategic Importance: The port exchanges trade primarily with Eastern countries, including Japan and China. It holds strategic importance for being the only Indian port with natural harbors.

Context for Businesses: If your business strategy targets Eastern markets, the Port of Visakhapatnam may be a valuable addition to your operations. It offers a naturally deep harbor, accommodating large vessels with ease.

Chennai Port

Location and Volume: Based in Coromandel Coast in the Bay of Bengal, the Chennai Port is integral for its capabilities in handling automobiles and general cargo, managing about 50 million tonnes annually.

Key Trading Partners and Strategic Importance: Major trading partners include the USA, China, Germany, and Malaysia. It holds strategic importance as a hub for automobile exports.

Context for Businesses: If your business focuses on automobile manufacturing and targeting markets in the US, China, Germany or Malaysia, then Chennai Port constitutes a key element in your shipping strategy.

Paradip Port

Location and Volume: Situated in Odisha on the east coast, Paradip Port is essential for handling bulk, liquid, and container cargo, with an impressive shipping volume of roughly 100 million tonnes.

Key Trading Partners and Strategic Importance: It has trade relations primarily with Eastern Asian countries and West African countries. Its strategic importance is due to its ability to handle a wide range of cargo.

Context for Businesses: For companies handling diverse types of cargo targeting Asian or African markets, Paradip Port's comprehensive logistics facilities may be very accommodating.

Should I choose FCL or LCL when shipping between Malaysia and India?

Making the right sea freight choice for your shipment from Malaysia to India – be it Full Container Load (FCL) or Less than Container Load (LCL), also known as consolidation – could make or break your logistics game. Let's delve into the nuances of these options, casting light on cost implications, delivery times, and operational success. This knowledge will enable informed decision-making for your specific shipping requirements. Ready to dive deep into the world of FCL and LCL? Let's get started on this crucial element of international shipping.

LCL: Less than Container Load

Definition: Less than Container Load (LCL) shipping allows multiple shippers to share space in the same container. It lets businesses transport smaller quantities of goods affordably and efficiently.

When to Use: LCL is typically the best choice when your cargo is small, generally less than 13/14/15 cubic meters (CBM). Its flexibility allows for precise control of your shipping volumes, reducing your costs and waste.

Example: Let's say you manufacture handcrafted wooden furniture in Malaysia and export to a niche market in India. Your orders vary and do not need a full container load. Here, LCL shipment lets you share container space with other exporters, saving costs and enabling regular shipments even with lower volume orders.

Cost Implications: Payment for LCL is based on the volume of your goods, measured in CBM, not the weight. Therefore, if your freight is dense and heavy but small in size, it can make LCL shipping more economical. However, do factor in potential additional charges like LCL handling fees, which make it costlier than FCL per unit volume.

FCL: Full Container Load

Definition: Full Container Load (FCL) shipping is the exclusive use of a 20'ft or 40'ft container for your cargo.

When to Use: FCL shipping is the go-to option when you have cargo more than 13/14/15 CBM. It's preferable for high volume shipments since it's more cost-efficient. Another advantage is the enhanced safety, as the container is sealed from origin to destination, preventing your goods from damage or loss during transit.

Example: Suppose you're a furniture manufacturer in Malaysia. Every month, you ship high-volume, bulky goods, say, 16 CBM to India. FCL would be the ideal option here, given the size and frequency of your shipments.

Cost Implications: The FCL shipping quote is relatively cheaper for larger volumes. Pricing is usually per container, instead of per volume or weight of the goods, which can be quite economical if you're transporting considerable amounts. However, keep in mind that rising freights and other customs duties can influence the final cost.

Unlock hassle-free shipping

Choosing between consolidation or a full container for Malaysia to India shipping can be mystifying. With DocShipper, untangle your shipping queries with ease! Our ocean freight experts evaluate factors like volume, urgency, and cost, guiding you towards the best choice for your business. Clearing the fog in international trade, we promise a smooth and hassle-free cargo shipping experience. Don't languish in confusion, connect with us now for a free estimation. Your hassle-free shipping journey begins with DocShipper.

How long does sea freight take between Malaysia and India?

Sea freight between Malaysia and India takes approximately 14-20 days on average. Insight into these transit times helps businesses we serve plan ahead. This duration, however, depends on specific factors such as the ports used, the weight of the cargo, and the nature of the goods. To receive a customised quote pertaining to your shipment, it is best to reach out to a reliable freight forwarder like DocShipper.

Below is a quick glance at the average transit times (in days) for sea freight between main ports in both countries:

| Malaysia Ports | India Ports | Average Shipping Time |

| Port Klang | Nhava Sheva | 6 days |

| Penang Port | Mundra Port | 8 days |

| Johor Port | Chennai Port | 18 days |

| Sabah Ports Authority | Kolkata Port | more than 30 days |

*Please note, these timelines are tentative and can vary based on factors discussed earlier.

How much does it cost to ship a container between Malaysia and India?

Ocean freight rates can be quite a conundrum, right? We're talking anything from around $50 to $1,000 per CBM between Malaysia and India. But, here's why the prices swing similar to a kiddy park. Points of Loading and Destination, the carrier employed, the type of cargo, and monthly market fluctuations all dance together to determine the final shipping cost. Claiming a definitive price here would be like shooting darts in the dark. But fear not. Our shipping specialists are ready to roll up their sleeves and dive into your specific needs, providing you with the best rates, individually tailored, for every shipment. Don't hesitate. We're here to simplify the process for you.

Special transportation services

Out of Gauge (OOG) Container

Definition: An Out of Gauge (OOG) Container refers to cargo that exceeds the standard container's dimensions in either length, width, or height, making it ideal for handling unusually shaped or oversized cargo.

Suitable for: Oversized machinery, large artworks, yachts, or heavy duty construction equipment.

Examples: Shipping earthmoving equipment from Malaysia to India.

Why it might be the best choice for you: If your business focuses on items that cannot fit into standard containers, an OOG container makes it possible, safe, and reliable to transport these goods.

Break Bulk

Definition: Break bulk is a shipping method where goods are loaded individually in bags, boxes, crates, drums, or barrels rather than in intermodal containers. Such goods are categorised as 'loose cargo load'.

Suitable for: Large or heavy items too large for containers, such as timber, steel or machinery.

Examples: Sending a consignment of steel rails from Malaysia to construction sites in India.

Why it might be the best choice for you: The individual handling of goods in break bulk shipping assures each piece of your cargo gets personal attention.

Dry Bulk

Definition: Dry bulk refers to the transportation of unpackaged non-liquid goods in large quantities, which are loaded and unloaded with a shovel or scoop.

Suitable for: Commodities like grain, coal, and iron ore.

Examples: Exporting large quantities of rice from Malaysia to India.

Why it might be the best choice for you: If your business revolves around the large-scale transportation of granular products, dry bulk shipping is a cost-efficient solution.

Roll-On/Roll-Off (Ro-Ro)

Definition: Ro-Ro is a shipping method designed for cargo that can be driven or rolled onto a ro-ro vessel. This makes it perfect for vehicles, trailers, and machinery.

Suitable for: Cars, trucks, trailers, and locomotives.

Examples: Shipping cars from an automobile factory in Malaysia to various dealerships across India.

Why it might be the best choice for you: If you handle wheeled cargo or vehicles, with Roll-on/Roll-off shipping, you can ensure a straightforward and secure delivery.

Reefer Containers

Definition: Reefer containers are refrigerated containers used to transport temperature-sensitive cargo.

Suitable for: Perishable goods such as fruits, vegetables, meats, and dairy products.

Examples: Exporting fresh Malaysian fruits to the Indian market.

Why it might be the best choice for you: If your cargo must remain at a certain temperature during transit, reefer containers provide the controlled environment you need for optimal product quality upon arrival.

Whatever your shipping needs may be, DocShipper can provide you with a free shipping quote in less than 24 hours. Don't hesitate to reach out, let us guide you to the right shipping solution for your business.

DocShipper Tip: Air freight might be the best solution for you if:

- You're pressed for time or facing a non-negotiable deadline. Air freight delivers unparalleled speed when it comes to transit times.

- Your shipment is modest in size, falling under 2 CBM. Air freight is particularly well-suited for these smaller consignments.

- Your supply chain includes destinations that are off the beaten maritime or rail paths. Air freight gives you access to a comprehensive global airport network.

Air freight between Malaysia and India

Swift and reliable, air freight is your fast track for shipping goods between Malaysia and India. Ideal for lightweight, high-value items - think electronics or time-sensitive documents - this type of shipping maximizes efficiency. You wouldn't take your diamond necklace with you on a three-week ocean liner trip, would you? Similarly, goods like these take the 'express lane' via air cargo.

But wait! Speedy shipping isn't as easy as just booking a flight. Like confusing weighing scales at the airport when you're not sure if your luggage is overweight, shipping costs can sky-rocket if you get the calculations wrong. Misguided choices can inflate freight charges—avoid getting a surprise like the unexpected excess baggage fee! Drilling deeper, we will arm you with best practices to dodge these common pitfalls.

Air Cargo vs Express Air Freight: How should I ship?

As a business owner looking for fast, efficient transport solutions between Malaysia and India, you've surely mulled over air cargo and express air freight. In a nutshell, while air cargo sees your goods sharing a plane ride with other shipments, express air freight is like opting for your product's personal jet - it's faster but costlier. In this guide, we'll compare these two options to help you find the perfect flight for your freight.

Should I choose Air Cargo between Malaysia and India?

Considering the potential weight of your cargo, choosing air freight could prove economical and reliable for shipping goods between Malaysia and India. Prominent airlines such as Malaysia Airlines and Air India offer cargo services on these routes. They are trusted, cost-effective, albeit structured around fixed schedules which may incur longer transit times. However, as your shipment surpasses 100/150 kg (220/330 lbs), this choice will increasingly match your budgetary needs and remain a viable trade-off for guaranteed delivery.

Should I choose Express Air Freight between Malaysia and India?

Express air freight, a niche service leveraging cargo-only planes, shines when transporting smaller shipments under 1 CBM or 100/150 kg (220/330 lbs). Choosing this option can fast-track your Malaysia-India business endeavors, particularly if time is critical. This expedited service, offered by internationally recognized couriers like FedEx, UPS, or DHL, ensures your cargo gets delivered at rocket speed. So, if rapid turnaround times and streamlined customs processing are high on your priority list, express air freight is a solid choice.

Main international airports in Malaysia

Kuala Lumpur International Airport

Cargo Volume: Handling over 1 million tonnes of cargo per annum, this is the busiest airport in Malaysia.

Key Trading Partners: China, India, Japan, Singapore, and Australia are among the top trading partners.

Strategic Importance: Positioned in an area serving over ASEAN 3 billion consumers, it is strategically located and plays a significant role in global trading.

Notable Features: Home to commercial airlines and dedicated cargo airlines. It offers modern cargo facilities including a Free Commercial Zone for trans-shipment goods.

For Your Business: If you are considering trading in the Asia Pacific region or with ASEAN countries, this airport's strategic location and comprehensive facilities can facilitate your shipping needs.

Penang International Airport

Cargo Volume: The airport handled close to 360,000 tonnes of cargo per annum.

Key Trading Partners: Primary trading partners include China, the USA, Singapore, Japan, and Hong Kong.

Strategic Importance: As the third busiest airport in the country, it serves as the main gateway to northern Malaysia.

Notable Features: The airport's cargo complex has been developed to meet the growing demand for air freight services, with particular strength in the handling of electronic and electrical goods.

For Your Business: If your products fall under the category of electronics and electrical goods, this airport could be beneficial as a shipping hub.

Sultan Abdul Aziz Shah Airport

Cargo Volume: Stations smaller cargo capacity, primarily serving domestic and short international flights.

Key Trading Partners: Majorly serves the Southeast Asian region.

Strategic Importance: Proximity to important industrial areas and free trade zones in Subang, Shah Alam, and Petaling Jaya.

Notable Features: The airport serves as an important cargo hub due to its location near the major industrial areas of the country.

For Your Business: Ideal for businesses that are looking to ship goods to local and nearby international locations due to its strategic geographical location.

Kota Kinabalu International Airport

Cargo Volume: As of 2022, the airport has a cargo volume of around 23,800 metric tonnes.

Key Trading Partners: Primarily the East Malaysian states and Singapore, as well as East Asian countries.

Strategic Importance: It is the gateway to the state of Sabah, given its position in East Malaysia.

Notable Features: The airport offers straightforward access to the untapped markets of the BIMP-EAGA (Brunei-Indonesia-Malaysia-Philippines East ASEAN Growth Area) region.

For Your Business: If you're targeting the East Asian market, this airport’s strategic location and reach offer an advantage for your shipping strategy.

Kuching International Airport

Cargo Volume: The airport moved approximately 22,000 metric tonnes of cargo annually.

Key Trading Partners: This airport sees shipments primarily to East Malaysian states, Singapore, and Indonesia.

Strategic Importance: Acts as an essential link between Sarawak and the rest of Malaysia.

Notable Features: The airport is in close proximity to Sarawak’s major industrial and agricultural areas.

For Your Business: If your business operates within these regions and industries, Kuching International Airport can provide valuable transport links for your commodity.

Main international airports in India

Indira Gandhi International Airport

Cargo Volume: 2 million metric tons in 2022.

Key Trading Partners: UAE, USA, Germany, Hongkong, and China.

Strategic Importance: Located in Delhi, the airport is the busiest in India and serves as a key hub for connecting flights across Asia.

Notable Features: The airport has two professional cargo terminals which ensure smooth handling of a wide variety of cargo.

For Your Business: As the busiest air cargo gateway in India, Indira Gandhi makes a logical choice for high-volume shipments, especially if your business deals with markets in the Middle-East, USA, or Asia.

Chhatrapati Shivaji Maharaj International Airport

Cargo Volume: 1 million metric tons in 2022.

Key Trading Partners: China, USA, Germany, UAE, and Sri Lanka.

Strategic Importance: Situated in Mumbai, this airport plays a significant role in connecting India with the western hemisphere.

Notable Features: The airport possesses a dedicated Air Cargo Complex for seamless cargo movement.

For Your Business: If your business's shipping needs primarily include West-bound, especially to locations in Europe and the Americas, choosing this airport could be a strategic decision.

Cargo Volume: 400,000 metric tons in 2023.

Key Trading Partners: Sri Lanka, Singapore, Dubai, Germany and Hong Kong.

Strategic Importance: Based out in Southern India, Chennai International aids in maintaining trade relationships with ASEAN, Middle East, and the African region.

Notable Features: The airport has a state-of-the-art Transshipment Centre and Cold Storage facilities.

For Your Business: Your business could take advantage of Chennai International for accessing the markets in the ASEAN region or for perishables requiring cold storage transport.

Kempegowda International Airport

Cargo Volume: 350,000 metric tons annually.

Key Trading Partners: USA, Sri Lanka, Singapore, France, and Germany.

Strategic Importance: Based in Bengaluru, the airport serves as a significant link for tech, engineering goods, and pharmaceutical industry.

Notable Features: The airport has a robust Pharma Zone dedicated to handle temperature-sensitive pharmaceutical shipments.

For Your Business: If your business specializes in tech, engineering, or pharmaceuticals, Kempegowda International could provide specialized handling for your cargo.

Rajiv Gandhi International Airport

Cargo Volume: 150,000 metric tons in 2022.

Key Trading Partners: UAE, Germany, USA, Qatar, and Singapore.

Strategic Importance: Located in Hyderabad, this airport facilitates connectivity towards the Middle East and the Pacific region.

Notable Features: The airport boasts of a modern Express Cargo Terminal and a Free Trade Warehousing Zone.

For Your Business: Rajiv Gandhi International may suit your needs if you have smaller, quick-turnaround shipments or need free trade warehousing facilities for your cargo.

How long does air freight take between Malaysia and India?

On average, air freight shipping between Malaysia and India takes around two to five days. However, please note that this timeframe can fluctuate depending on certain factors. Your shipment's specific departure and arrival airports, the weight of your goods, and their nature, can all significantly affect transit times. For the most accurate shipping times tailored to your unique needs, it's recommended to consult with a freight forwarding expert, such as DocShipper.

How much does it cost to ship a parcel between Malaysia and India with air freight?

Shipping an air freight parcel between Malaysia and India typically averages around $2-10 per kg. However, determining an exact price isn't straightforward. Costs can vary based on multiple factors including the distance from departure and arrival airports, package dimensions and weight, and the nature of goods transported. But rest assured, our dedicated team will work closely with you, providing the best rates tailored to your specific needs. Every quote we issue is uniquely calculated on a case-by-case basis. Contact us to receive a free quote in less than 24 hours.

What is the difference between volumetric and gross weight?

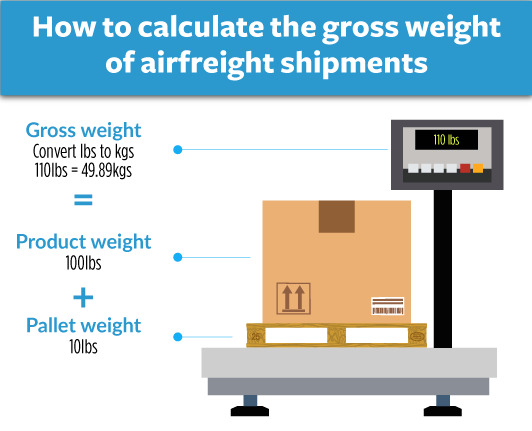

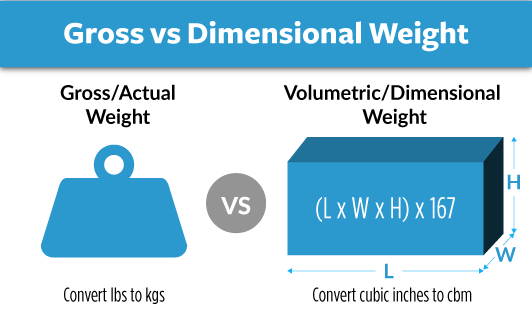

When it comes to air freight shipping, 'gross weight' refers to the actual weight of your shipment, including the goods and any packaging material. This is the literal weight that you'd get if you placed your package on a scale.

On the other hand, 'volumetric weight' is a calculation that reflects the package’s density—the amount of space it takes up in relation to its weight. This is often used in air freight shipping as size can matter as much as weight.

Here's how each is calculated:

1. Gross weight: Simply weigh the total shipment and record the weight in kilograms (kg).

2. Volumetric weight: This is a bit more complex. Take the dimensions of the package in centimeters—length, width, and height—and multiply them together. Then divide by 5000.

Let's illustrate this with a hypothetical shipment. Suppose you have a box that measures 50cm x 40cm x 30cm and weighs 20kg.

The gross weight is 20kg (44 lbs).

For the volumetric weight, you'd multiply the dimensions together (504030 = 60000) then divide by 5000. This gives us a volumetric weight of 12kg (26.46 lbs).

When determining freight charges, carriers consider both weights and charge based on which is higher. In our example, since the gross weight (20kg) is higher than the volumetric weight (12kg), you would be billed based on the gross weight. This procedure ensures that carriers are compensated for their capacity, whether space-based (volumetric) or weight-based (gross).

DocShipper tip: Door to Door might be the best solution for you if:

- You value convenience and want a seamless shipping process, as door-to-door takes care of every step from pickup to delivery.

- You prefer a single point of contact, as door-to-door services typically provide a dedicated agent to handle all aspects of the shipment.

- You want to minimize the handling of your goods, reducing the risk of damage or loss, as door-to-door minimizes transitions between different modes of transport.

Door to door between Malaysia and India

Here's the skinny on international Door to Door shipping—it's a convenient option that takes care of your goods from Malaysia straight to an address in India. Offering myriad benefits like less hassle, more pricing transparency, and efficient timelines. And who wouldn't like a hassle-free, cost-effective solution, right? So, sit tight, let's unbox the world of Door to Door shipping together!

Overview – Door to Door

Carrying goods from Malaysia to India can seem like a daunting task. Unpredictable hurdles and complex paperwork can often slow you down. Thankfully, our sought-after Door-to-Door shipping service can neutralize this stress. Handing us the reins means you watch your goods go from A to B without the worry of customs, duties, or delays. Enjoy the seamless transportation that many of our clients trust, while also being aware that associated costs are sometimes higher than other shipping options. Choose Door-to-Door shipping for a hassle-free logistics solution.

Why should I use a Door to Door service between Malaysia and India?

Ever shipped a box and felt like it went on a wilder adventure than you ever have? Well, with Door-to-Door services between Malaysia and India, you can make your package’s voyage a soothing cruise, instead of an epic odyssey. Here’s why:

1. Stress-Free Logistics: Let’s be honest, freight forwarding comes with its own set of migraines. Door-to-Door service takes that burden off your shoulders, managing everything from picking up goods from the point of origin and handling all transport stages till it reaches your final stop in India—easing your logistics load.

2. Timely Delivery: Racing against the clock? Door-to-Door service can be your champion in this race! With a fine mesh network and stringent adherence to timelines, these services prioritize punctuality, perfect for your time-sensitive shipments.

3. Special Care for Complex Cargo: Think of it as 'VIP treatment' for your cargo! If your cargo is a diva—oversized, temperature-sensitive, or requiring particular handling—it gets the attention it deserves throughout the journey.

4. All-in-One Convenience: The comprehensive nature of Door-to-Door service combines multiple logistics elements into one, saving you from juggling between carriers, modes of transport, and invoices. One provider, one price, and one point of responsibility make it an enticing offering.

5. Final Mile Delivery: The journey's last leg can be tricky. But Door-to-Door service navigates these final steps with finesse, delivering your shipments to the exact location, even in the remotest points in India.

So, why not give your shipment the smooth journey it deserves, by opting for Door-to-Door service? It's like upgrading your cargo from economy to first-class!

DocShipper – Door to Door specialist between Malaysia and India

Simplify your international shipment with DocShipper - expertise in seamless door-to-door shipping from Malaysia to India. We've got you covered every step of the way, from packing your goods to navigating customs to selecting the best shipping method. Get a dedicated Account Executive at your service, allowing you to sit back and relax while we streamline your logistics needs. Contact us for a free, no-obligation quote within 24 hours, or connect with our consultants for complimentary advice. Discover the DocShipper advantage today.

Customs clearance in India for goods imported from Malaysia

Customs clearance plays a crucial role when importing goods from Malaysia to India. However, it's not a simple process, with unexpected fees and hidden charges often lurking below the surface. Understanding the nuances of customs duties, taxes, quotas, and licences is key. Otherwise, you might find your shipment stuck in customs, bringing your operation to a standstill. This guide is designed to demystify these challenges to prevent costly and time-consuming issues. Rest assured, DocShipper is ready to help you through all these and more. No matter where in the world your goods originate, their value, or the HS Code, our team can guide you smoothly through the process, giving accurate estimates to help budget your project. But remember, providing these three details is mandatory to proceed with the estimation. So, let's dive in!

How to calculate duties & taxes when importing from Malaysia to India?

When you're looking to move goods from Malaysia to India, getting a clear understanding of the duties and taxes involved in the import process is key to success - and maintaining your budget. This estimation revolves around five major components: the country of origin, the Harmonized System Code (HS Code) of the product, the customs value, the tariff rate applicable and any extra taxes or fees specific to the goods you're shipping.

The journey begins with identifying the country where the goods were manufactured or produced, which sets the initial stage of calculating the ensuing charges. This is no mere detail - it's a critical starting point and first step in your import process that shouldn't be overlooked.

Step 1 - Identify the Country of Origin

Determining the country of origin for your goods - in this case, Malaysia - is the very first stride in your import journey to India. It's more than a basic fact; it's paramount for five reasons.

Firstly, it forms the basis to calculate your tariff using the essential Harmonized System (HS) code. Second, it’s not just about where the goods are manufactured. As per the rules of origin, it's defined by where substantial transformations occurred. Third, it affects anti-dumping duties. For instance, commodities made in countries with dumped prices may invite higher levies.

Fourth, India and Malaysia share a prolific trade agreement under the ASEAN India Free Trade Area. This reciprocity can lead to lower customs duties and streamline your import process. Lastly, each country possesses unique restrictions; knowing your country of origin helps obey these rules wisely.

Remember, India has specific import limitations on certain goods from Malaysia, like live animals and selected dairy products. Think ahead, understand your good's classification, and prepare for potential restrictions in advance to avoid hiccups at customs.

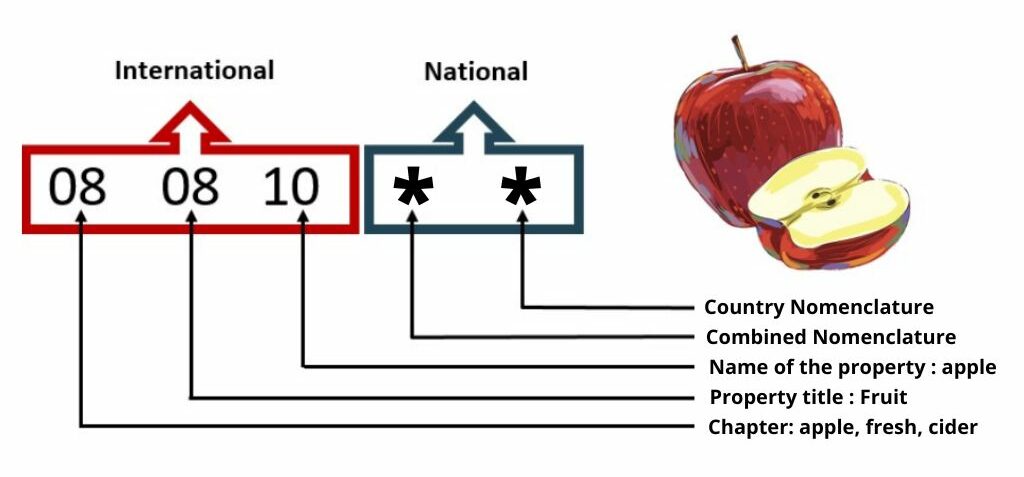

Step 2 - Find the HS Code of your product

The Harmonized System (HS) code is a universally accepted classification system for goods. It is used by customs authorities around the world to identify products when assessing duties and taxes. Think of it as an international language of product nomenclature. Identifying the correct HS Code of your product is pivotal to ensuring your international shipping goes smoothly.

One of the most straightforward approaches to determine your product's HS code is to ask your supplier. Suppliers have an extensive understanding of the goods they're involved with, including the HS Codes relevant to their products.

In case this avenue isn't accessible, you don't need to worry. You can figure out the HS code for your product using a few simple steps, courtesy of the Harmonized Tariff Schedule tool. Through this tool, you simply input the name of your product in the search bar. The tool will populate results, from which you can look to the Heading/Subheading column to find your accurate HS Code.

Make absolute sure to choose the correct HS code for your product. Inaccuracies can lead to delays in shipping, higher costs in duties and taxes, and potential penalties. Precision in this step is non-negotiable to avoid hindrances during the shipping process.

Here's an infographic showing you how to read an HS code. This will further clarify any ambiguous areas and provide a visual guide to support your understanding of this crucial aspect of international shipping.

Step 3 - Calculate the Customs Value

If you've ever wondered what a customs value is, it's essentially the total value of your goods, including the initial price, international shipping cost, and insurance cost. Unlike the product value, which is just the price you paid for the goods, the customs value forms the basis for calculating customs duties. Picture this: you've bought exclusive spices from Malaysia for $1000. To deliver them safely to India, you spend $500 on shipping and $50 for insurance. Adding it all up, your customs value would be $1550, not just the initial product value of $1000. This total value is what customs uses to apply any duty rates, so calculating the correct customs value is key to avoiding unwelcome surprises when you import goods. Understanding this distinction can make your shipping experience smoother and more budget-friendly, so it's a good equation to keep in mind!

Step 4 - Figure out the applicable Import Tariff

Import tariffs are taxes imposed on goods when they cross international boundaries. In India, these tariffs are mainly classified into the Basic, Additional, and True Countervailing types, each serving a distinct purpose.

To find the applicable tariff rate for your product, follow these steps:

1. Refer to India's Central Board of Excise and Customs (CBEC) website for the list of tariffs.

2. Search for your product's Harmonized System (HS) code, which we'll assume to be 1511.10 - the code for crude palm oil from Malaysia.

3. Identify the tariff corresponding to that specific code. Let's say, it's 45%.

Next, you need to calculate the import duties. For instance, consider your total CIF (Cost, Insurance, and Freight) cost is USD 1000. Your import duty would be:

Import Duty = Tariff Rate CIF

= 45% USD 1000

= USD 450

Remember, these calculations are illustrative and actual rates may vary. Always verify with official resources to get accurate information.

Step 5 - Consider other Import Duties and Taxes

In the characteristic labyrinth of global shipping, it's crucial to factor in other potential charges beyond the standard tariff rate. These additional costs often hinge on the country of origin and the type of product being imported or exported.

For instance, take excise duty - a tax often levied on goods produced within the country, but also can apply to certain imported goods. If you're importing a product subject to excise duty from Malaysia, you might get hit with this added cost!

Anti-dumping duties might also apply. Say there's a type of widget traded internationally. It's sold for $100 normally, but one nation starts exporting it values low as $60. An anti-dumping duty could be applied by the importing country to protect its own widget industry. It's like a financial shield against unfairly cheap imports!

Then comes Value Added Tax (VAT). This tax is a significant part of import costs, and varies widely. For instance, let's assume the basic VAT in India is around 18% (but this could change!). On a $1000 shipment, that's an extra $180 you'd need to factor into your costs.

Remember, these are just illustrative examples. The actual rates will vary depending on a myriad of factors. Always consult a knowledgeable customs broker or your freight forwarder for accurate cost estimates. They're like navigational stars in the journey of international trade, guiding you safely through your fiscal voyage!

Step 6 - Calculate the Customs Duties

As part of your shipping journey from Malaysia to India, calculating customs duties is a crucial step. The formula entails summing customs value with any anti-dumping taxes to get Assessable Value. The customs duties can then be calculated as a percentage of this combined value. Keep in mind the Value Added Tax (VAT) is a separate charge, that's applied on top of the computed duties.

Say you have a customs value of $20,000, without any VAT. If customs duties are 10% and no anti-dumping taxes, you'd pay $2,000 in duties. If another shipment with the same 10% customs duties involves a 15% VAT, your customs duties are still $2,000, with an added VAT of $3,000. For a complex case harboring customs value of $20,000, 10% customs duties, 15% VAT, anti-dumping taxes of $1,000 and an excise duty 5%, the payable duties amount to $2,000, VAT to $3,000, plus the $1,000 anti-dumping taxes and $1,000 Excise Duty.

These calculations can become complex given the multitude of associated taxes and duties. This is where DocShipper steps in, taking care of every step of the customs clearance with precision and efficiency, ensuring you don't overpay. Contact us for a free quote in less than 24h, and let us navigate the complexities of international shipping for you.

Does DocShipper charge customs fees?

When you engage DocShipper for your customs clearance in Malaysia or India, rest assured that we charge only for our services and not the customs duties and taxes. These government fees are separate and go directly to the state. Confusion often arises over this distinction. Think of it this way - if you're dining at a restaurant, you pay both the cost of your meal (analogous to customs duties) and also a service charge (just like clearance fees). And to keep things transparent, we provide you with official customs documents, so you see exactly where every penny went. No nasty surprises, only clear, accountable service.

Contact Details for Customs Authorities

Malaysia Customs

Official name: Royal Malaysian Customs Department

Official website: https://www.customs.gov.my/

India Customs

Official name: Central Board of Indirect Taxes and Customs

Official website: https://www.cbic.gov.in/

Required documents for customs clearance

Confused about customs clearance paperwork? Let's untangle the intricacies! Uncover what a Bill of Lading, Packing List, Certificate of Origin, and Documents of Conformity (CE standard) mean and why they're crucial to smooth international shipping. It’s more than daunting jargon; it’s your key to unlocking successful border passage. Dive in!

Bill of Lading

Your Bill of Lading is no routine paperwork; it's your golden ticket when shipping goods from Malaysia to India. This document not only serves as a contractual agreement, showing that your cargo has been loaded, but also marks the ownership shift from seller to buyer. Plus, it's a godsend in the advent of e-commerce, with a telex release option promising faster, efficient document exchanges without the hang-ups of courier delays. Fancy air cargo? Keep in mind the equivalent – an Air Waybill (AWB). Remember, an incorrect Bill of Lading could mean your shipment getting lost in customs limbo, so double-check the details. Happy shipping!

Packing List

For a hassle-free shipment from Malaysia to India, a Packing List goes beyond just an itemised container. It's a ticket to making your goods travel stress-free! As a shipper, you take full charge of creating this lifeline document, accurately capturing every unit, weight aspect, and description of your goods. Picture this - your shipment holds 50 crates of electronic parts. Any mismatch in documenting even a single crate might signal trouble at the customs, both at sea and air freight. It's not just about avoiding misdeclaration penalties; it's your golden ticket to expedite procedures, smooth transit, and happy customs officials! Remember, accuracy in your Packing List is not just recommended but an absolute must!

Commercial Invoice

For a smooth customs clearance process when shipping between Malaysia and India, your Commercial Invoice plays a crucial role. This document should detail the goods being transported - consider it a birth certificate for your shipment. Crucially, it must align with details on your Bill of Lading or Airway Bill. Inconsistencies can trigger customs delays. For instance, if your shipment contains 600 '100% cotton men's shirts', ensure each document reflects this. Specify the shirt's unit value too, say 'USD 5 per piece'. Proper alignment and complete, accurate descriptions reduce clearance hiccups, saving your business time and money. Apply this strategy to keep your goods moving smoothly!

Certificate of Origin

Navigating customs from Malaysia to India? You'll need a Certificate of Origin. It verifies the 'birthplace' of your goods. For instance, if you're shipping electronic components produced in Penang to New Delhi, this document keeps things transparent about the origins. Why so important? Mainly, it's about potential savings. Certain products made in Malaysia might benefit from reduced customs duties in India under trade agreements. So, ensuring the Certificate of Origin correctly mentions 'Malaysia' can have a real impact on your shipping costs. Think of it like a golden ticket - it's not just a piece of paper, but a passport to smooth, cost-effective shipping.

Get Started with DocShipper

Navigating the complexities of customs clearance between Malaysia and India can be overwhelming. At DocShipper, our expertise ensures a seamless flow at every step - from necessary paperwork to on-point compliance. Ensure no unexpected costs or delays by teaming up with us. Reach out now and get a free, no-obligation quote within 24 hours. Let us simplify your international shipping today.

Prohibited and Restricted items when importing into India

To avoid headaches at customs, it's crucial to be aware of India's import laws. Knowing the ins and outs of prohibited and restricted items can save your business time, money, and legal troubles. In this guide, we will demystify the complex rules for a smoother import experience.

Restricted Products

- Live Animals and Products: You have to apply for a permit from the Department of Animal Husbandry, Dairying, and Fisheries Ministry of Fisheries, Animal Husbandry and Dairying.

- Plant Seeds and Soil: Special permission is needed from the National Seeds Corporation Limited, Ministry of Agriculture and Farmers Welfare.

- Arms and Ammunition: You must secure an Arms License from the Ministry of Home Affairs.

- Pharmaceuticals and Cosmetics: You need to acquire a license from the Central Drugs Standard Control Organization, Ministry of Health and Family Welfare.

- Alcohol: You have to secure an import licence from the State Excise Department of the respective state For example: Delhi Excise Department.

- Telecommunication Equipment: You require an 'Equipment Type Approval' from the Department of Telecommunications, Ministry of Communications.

- Nuclear Materials and Equipment: Permission is needed from the Department of Atomic Energy.

- Precious Metals, Stones, and Jewellery: You have to apply for a certificate from The Bureau of Indian Standards, Ministry of Consumer Affairs.

- Drones and Unmanned Aerial Vehicles: A permit is required from the Director-General of Civil Aviation, Ministry of Civil Aviation.

- Tobacco and Tobacco Products: You must obtain a tobacco license from the State Tobacco Control Cell of the respective state For example: Maharashtra State Tobacco Control Cell.

- Endangered Species and Wildlife Products: You need approval from the Ministry of Environment, Forest and Climate Change, Directorate of Wildlife.

Prohibited products

- Narcotics and illicit drugs

- Live plants and animals without a permit

- Precious metals and stones that aren't declared

- Perishable infectious biological substances

- Radioactive materials

- Obscene materials and pornography

- Press publications, drawings or caricatures offensive to a country or its officials

- Maps and literature where Indian external boundaries have been shown incorrectly

- Counterfeit currency

- Certain types of air conditioning units

- Rudraksha seeds

- Animal fat and oils

- Ivory, rhino horn, tortoise shell, musk, certain reptile skins, and goods made of these materials

- Certain refurbished and second-hand goods

- Any goods which the Central Government declares as unsafe or hazardous under the Environment (Protection) Act, 1986

- E-waste

- Cars where the steering wheel is on the right side of the vehicle

- Cigarettes electronic, cigars electronic, and similar products containing nicotine.

- Lottery tickets and advertisements

- Paan masala and gutkha

Please note that this list may not be exhaustive. Always refer to the current customs regulations and consider consulting with a freight forwarding or customs agent before importing goods into India.

Are there any trade agreements between Malaysia and India

Yes, India and Malaysia are partners under the ASEAN-India Free Trade Area and have a bilateral Comprehensive Economic Cooperation Agreement, creating a significant opportunity for businesses shipping goods between these two nations. These agreements ease import/export procedures and can reduce duties. It’s essential to be up-to-date with their terms for your shipment's smooth handling. Currently, there’s ongoing engagement for enhancing economic ties, hinting at future trade facilitation and infrastructure projects. Exploring these can give your business a competitive shipping edge.

Malaysia - India trade and economic relationship

Malaysia and India share a robust trade and economic relationship dating back centuries. From its roots in the ancient Spice Trade to today's modern globalized economy, this relationship has shown remarkable growth and resilience. Key sectors include information technology, oil and gas, palm oil, and rubber, with the latter two reflecting Malaysia's rich natural resources.

India Exports to Malaysia was US$6.68 Billion during 2023, according to the United Nations COMTRADE database on international trade. India Exports to Malaysia - data, historical chart and statistics - was last updated on July of 2024.

Your Next Step with DocShipper

Business overwhelmed with logistics between Malaysia and India? DocShipper can lift the weight off your shoulders! We handle every step, from transport to customs, ensuring your goods arrive on time, every time. Tap into our expertise and simplify your shipping procedures today. Need seamless shipping solutions? Contact us now.

Additional logistics services

Dive into a suite of value-added logistics services. From warehousing to distribution, DocShipper streamlines your supply chain from start to finish, transforming the tiresome task into a trouble-free triumph.

Warehousing and storage

Finding the right warehouse in India for goods from Malaysia can be tricky, especially when temperature control is critical. Imagine storing fine chocolates in a humid depot, a disaster, right? That's where our specialized warehousing services come in handy. Kiss goodbye to sleepless nights over storage troubles. Ready for a change? More info on our dedicated page: Warehousing.

Packaging and repackaging

Just imagine your crated ceramics arriving in Delhi with not a single crack! Oh, the joy! Proper packaging and repackaging is the unsung hero that makes this possible, especially when shipping from Malaysia to India. Trust a reliable agent to handle everything from wrapping electronics to securing antiques. Want to find out how we cater to a galaxy of products? Head over to our detailed guide: Freight packaging.

Cargo insurance

Things can get bumpy on the high seas or on rough roads. That's why you need Cargo Insurance over fire insurance - it covers damage to your goods during transit. Picture this, a container full of high-value electronics gets drenched during a seaborne typhoon - poof, there goes your profit. But with Cargo Insurance, your investments are safeguarded. Intrigued? Find all the details on our dedicated page: Cargo Insurance.

Supplier Management (Sourcing)

Choosing the right suppliers can indeed be a daunting task, especially in regions like Asia and East Europe. DocShipper supervises every step of the sourcing process, eradicating language barriers and guiding your business to success. Imagine the ease of having experts handpick suppliers and streamline procurement. For insightful details, head to our dedicated page: Sourcing services.

Personal effects shipping

Moving your cherished valuables between Malaysia and India? Let our expert team manage the transport of your delicate or oversized items responsibly. Benefit from personalized service tailored to your unique requirements while ensuring safe transit. Picture the flawless relocation of your grand piano or vintage mirror! Prefer more insights? Check our dedicated page: Shipping Personal Belongings for in-depth details.

Quality Control

Minimizing risks in your Malaysia-India supply chain starts with rigorous quality control. Imagine launching a new line of custom furniture, only to discover on arrival that poor workmanship makes them unsellable. Our timely Quality Control service saves you from such costly nightmares, ensuring your products meet top-notch standards before crossing borders. Avoid pitfalls by choosing certainty over surprises. More info on our dedicated page: Quality Inspection

Product compliance services

Export or import, keeping your goods compliant to destination regulations is crucial. Imagine shipping toys unaware of safety standards. We eliminate this stress by providing laboratory tests for your product, ensuring certification and compliance with all necessary regulations. Gain peace of mind and avoid the potential fines or shipment delays. More info on our dedicated page: Product compliance services.

FAQ | For 1st-time importers between Malaysia and India

What is the necessary paperwork during shipping between Malaysia and India?

When shipping from Malaysia to India, we as DocShipper require specific documents to ensure a smooth process. A bill of lading is necessary for sea freight, while an air waybill is for air freight - we'll handle these for you. What we'll need from your end is the packing list and the commercial invoice. Depending on the nature of your goods, there may be additional requirements, such as a Material Safety Data Sheet (MSDS) or certification. These documents aid in streamlined customs clearance, so their accuracy and completeness are crucial. Our team will guide you thoroughly to ensure all paperwork is in order.

Do I need a customs broker while importing in India?

Yes, employing a customs broker when importing goods into India is highly advisable due to the complexities of customs processes and the numerous mandatory documents to provide. Given this intricacy and to ease the procedure for you, at DocShipper, we act as your representative during customs clearance for most shipments. Our expertise and experience in navigating these complicated systems ensure efficient processing, enabling your cargo to reach its destination in the fastest possible time. With our team handling this essential task, you can be assured peace of mind knowing professionals are managing your shipment at every step of the way.

Can air freight be cheaper than sea freight between Malaysia and India?

While it's challenging to provide a blanket answer due to variables such as route, weight, and volume, we at DocShipper can generally suggest that if your cargo is less than 1.5 Cubic Meters or weighs under 300 kg (660 lbs), air freight might be a more cost-effective choice between Malaysia and India. However, please note that every situation is unique and carefully evaluated by your dedicated account executive at DocShipper who will ensure the most competitive shipping option for your specific needs.

Do I need to pay insurance while importing my goods to India?

While insurance isn't explicitly required for shipping goods, either locally or internationally, we at DocShipper would highly advise you to consider it. Transporting goods comes with various risks such as damage, theft, or loss, and insurance can offer protection against such unfortunate incidents. Particularly for international shipments, investing in insurance can ensure your peace of mind during transit and delivery.

What is the cheapest way to ship to India from Malaysia?

For cost-effective shipping from Malaysia to India, we recommend sea freight, especially for larger shipments. Both countries enjoy robust ports, facilitating easy maritime transport. However, if your cargo is smaller or time-sensitive, air freight can be considered, but it's pricier. Remember, while choosing, factors like cargo weight, volume, nature, and urgency also play a key role. Consult with us at DocShipper for a detailed, personalized solution.

EXW, FOB, or CIF?

When deciding between EXW, FOB, or CIF, your relationship with your supplier plays a significant role. Suppliers typically sell under EXW - meaning from their factory door, or FOB - also covering all local charges until origin terminal. However, bear in mind that suppliers might not excel in logistics matters. At DocShipper, we specialize in handling the complexities of international freight and destination processes, a service that your supplier may not provide. With this in mind, tapping into the expertise of a dedicated agent like us can streamline the entire shipping process. We're proud to offer comprehensive door-to-door services, so irrespective of the terms with your supplier, we've got you covered!

Goods have arrived at my port in India, how do I get them delivered to the final destination?

As DocShipper, if your cargo arrives at an Indian port under CIF/CFR incoterms, you need a customs broker or freight forwarder to clear goods, handle import charges, and delivery. You can alternatively hire us for DAP incoterms, where we manage everything. Always discuss these details with your account executive to ensure clarity.

Does your quotation include all cost?

Indeed, at DocShipper, we ensure complete transparency in our quotations. The estimate includes all charges with the exception of duties and taxes at your shipment's destination. However, feel free to ask your designated account executive to provide an estimate of these costs. This way, we prevent the occurrence of any hidden fees or unforeseen expenses.