Ready to ship goods from the sizzling street markets of Malaysia to the grand duchy of Luxembourg - but feeling bewildered by the transportation process? Key challenges you might face in this international freight forwarding venture include grasping convoluted accounting of rates, unpredictable transit times, and the intricacies of customs protocols.

Fear not! This guide is meticulously penned to help you apprehend these pain points. Touching upon topics like the different freight options available (air, sea, road, and rail), and drilling down into specific information about customs clearance, duties, taxes, we have seasoned advice to aid businesses striving for seamless shipping between these two countries.

If the process still feels overwhelming, let DocShipper handle it for you! As an international freight forwarder, we expertly navigate every step of your shipping journey, turning the bacteria-riddled minefield of logistics into a straightforward path towards success for you!

Table of Contents

Which are the different modes of transportation between Malaysia and Luxembourg?

Discovering the smartest way to transport goods between Malaysia and Luxembourg is a bit like planning a grand journey. Imagine it's like hopping on a train, the scenic route, or jetting off on a plane - an express trip! Geographically, it's not a stone's throw away. A roller-coaster ride of a train or a road trip is not an option, as these countries live in different continents. Air or sea freight become our leading characters. The choice depends on your 'tour' preferences - speed, costs, and the bulkiness of your luggage or in this case, your shipment!

How can DocShipper help?

When shipping your goods from Malaysia to Luxembourg, you can trust DocShipper's expertise to simplify the process. We offer seamless coordination of transport, customs clearance, and administrative tasks. Fed up with shipping complexities? Connect with our consultants for a free 24-hour estimate or to have your questions cleared up, free of charge. Your shipping partner is only a call away.

DocShipper Tip: Sea freight might be the best solution for you if:

- You're dealing with hefty quantities or oversized goods. Sea transport is your go-to for maximizing space without stretching your budget.

- Time sensitivity isn't a concern for your shipment. Ocean freight is known for its leisurely pace, especially when compared to the speed of air or rail.

- Your supply chain connects key international harbors. This positions you to take full advantage of a wide-reaching network of ocean trade routes.

Sea freight between Malaysia and Luxembourg

Oftentimes, the bustling ports of Malaysia and Luxembourg serve as important pillars for the vibrant trade relationship between these two countries. Malaysia, with its renowned Port Klang, and Luxembourg, boasting the well-connected Port of Mertert, form indispensable hubs in the movement of sizeable shipments via ocean freight - the most cost-effective way to transport high-volume cargo, albeit the time taken.

But here's the crux. The challenge isn't whether you can ship your goods, it's how you do it effectively. Ocean shipping between these two distant locales can feel like threading a needle in the dark. Dealing with complex shipping regulations, nuanced customs requirements, and other often-overlooked tidbits can be a steep learning curve. Many businesses stumble. But it's not rocket science! It's about understanding the best practices and tailoring them to your situation.

In the following sections, we’ll shed light on the dos and don'ts of shipping between Malaysia and Luxembourg to guide your trade voyage smoothly.

Main shipping ports in Malaysia

Port Klang

Located in Selangor, this port is the largest in Malaysia, handling about 13.5 million TEUs (Twenty-Foot Equivalent Units) of cargo in 2023. This port plays a vital role in the country's economic growth.

Key Trading Partners and Strategic Importance: Primary trading partners include China, Singapore, the European Union, and the USA. Port Klang is strategically important due to its proximity to the country's largest consumer market, Kuala Lumpur, and its integration with Malaysia's railway network.

Context for Businesses: If you're looking to tap into consumers in the vibrant city of Kuala Lumpur, Port Klang can offer you the quickest shipping route due to its strategic proximity and integrated transport network.

Port of Tanjung Pelepas

Situated at the eastern tip of the western Malaysian peninsula, this port is the second busiest in the country, boasting a capacity of over 12.5 million TEUs in 2023.

Key Trading Partners and Strategic Importance: Most significant trading partners include the Asia Pacific region, North America, and Europe. The Port of Tanjung Pelepas also serves as a major transshipment hub.

Context for Businesses: To reach markets located in Asia, North America, and Europe effectively, the Port of Tanjung Pelepas is a prime choice due to its extensive network connections and status as a preferred port of call for major shipping lines.

Port of Penang

Located on the north-western coast of Peninsular Malaysia, the Port of Penang handled about 2.1 million TEUs in 2021.

Key Trading Partners and Strategic Importance: Its top trading nations are the ASEAN countries, followed by other regions such as East Asia, India, Europe, and the United States. This port is notable for its attractive and strategic location on one of the busiest shipping routes.

Context for Businesses: If your target markets are within the ASEAN region, this port can cater to your needs due to its strategic location and high-frequency services to these markets.

Port of Bintulu

Situated on the island of Borneo, this is Malaysia’s main bulk cargo terminal and it handled 364,169 TEUs in 2022.

Key Trading Partners and Strategic Importance: Trading partners include Brunei, Indonesia, the Philippines, Thailand, and Papua New Guinea. This port is particularly important due to handling the most significant part of Malaysia's LNG (Liquefied natural gas) exports.

Context for Businesses: If your business deals heavily with energy-related commodities, then Port of Bintulu is well equipped and ideally positioned to serve your business needs.

Port of Johor

Located at the southwestern tip of Peninsula Malaysia, it is one of the most important commodity ports in the country, although it handles lesser TEUs in comparison.

Key Trading Partners and Strategic Importance: Key trading partners include Indonesia, Thailand, and Singapore. This port plays a crucial role in servicing these markets due to its proximity and good connectivity.

Context for Businesses: If you are targeting the fast-growing consumer markets of Indonesia, Singapore, and Thailand, then the Port of Johor is your best bet due to its strategic location.

Port Kuantan

Located on the east coast of the Peninsula, Port Kuantan is an all-weather port and the nearest Malaysian port to the South China Sea.

Key Trading Partners and Strategic Importance: Key trading partners include China, Japan, India, and Australia. The port is of strategic importance due to its closeness to the South China Sea.

Context for Businesses: If you’re targeting markets on the eastward shipping routes, such as China, Japan, India, or Australia, then Port Kuantan is ideally located to play an integral role in your logistics strategy.

Main shipping ports in Luxembourg

Port of Mertert

Location and Volume: Located in the Grevenmacher district along the Moselle river, the Port of Mertert is Luxembourg's only international container port. It has a shipping volume of 1.3 million tonnes annually, handling various kinds of freight, such as dry bulk, containers, and general and heavy cargo.

Key Trading Partners and Strategic Importance: Given Luxembourg's strategic location within the European Union, the port has a significant role in the transportation of goods to major economic areas of Europe, with Germany, France, and Belgium being key trading partners. It serves as a multimodal transport hub and provides a critical connection to comprehensive rail, road, and inland waterway networks.

Context for Businesses: If you are seeking to penetrate the European market, integrating your logistics with the Port of Mertert could be a valuable strategy. This is particularly advantageous for businesses dealing with heavy and large industrial goods, given the port's specialized infrastructure for such items. Additionally, their expert handling of multimodal logistics can simplify your shipping process and increase your efficiency.

Should I choose FCL or LCL when shipping between Malaysia and Luxembourg?

As you tackle the puzzle of shipping goods from Malaysia to Luxembourg, selecting between Full Container Load (FCL) and Less than Container Load (LCL), familiarly known as consolidation, is no minor detail. This decision can sway costs, delivery times, and ultimately, the success of your business operations. Over the next sections, we'll break down these sea freight options, illuminating their pros and cons, to arm you with the knowledge you need to make a strategic, cost-effective choice tailored to your specific needs. Let's embark on this maritime journey together!

LCL: Less than Container Load

Definition: Less than Container Load (LCL) shipping involves sharing a container with other shipments, which is ideal when you don't have enough goods to fill an entire container. LCL shipment provides more cost-effective solutions for smaller volumes of cargo.

When to Use: LCL freight is a great option when you're transporting goods that occupy less than 13, 14, or 15 cubic meters (CBM). This is because you only pay for the space you use, instead of paying for a whole container.

Example: Let's imagine your business needs to ship 10 CBM of home appliances from Malaysia to Luxembourg. It doesn't make economic sense to book a full container; that's where LCL comes in. Your goods will be consolidated with other shipments in the same container, saving you money.

Cost Implications: While LCL can be more cost-effective for small volumes, remember that each LCL shipment involves additional handling due to the consolidation and deconsolidation processes. This can sometimes lead to slightly higher costs per CBM compared to Full Container Load shipments. Additionally, because your goods are shipped with others, there could be potential delays if other goods in the same container are held up during customs clearance.

FCL: Full Container Load

Definition: FCL, or Full Container Load, in shipping lingo, means using an entire 20ft or 40ft container specifically dedicated to your goods. This ensures that the container is sealed from pickup to drop-off providing maximum security.

When to Use: FCL shipping proves advantageous when your cargo size ranges over 13/14/15 cubic meters (CBM). This saves you money on a per-unit basis making FCL shipping a cheap option for high-volume cargo.

Example: Let's take Zen Electronics as an example, a company that deals with AC units. They regularly ship cargo more than 15 CBM to Luxembourg. Choosing FCL ensures savings for them as they fill up either a 20'ft or 40'ft container entirely with their goods.

Cost Implications: FCL shipping quote is based on a flat rate per container - thus making it significantly cheaper per unit for high volume shipments. However, it's worth noting that you're responsible for them entirely - regardless of whether they're filled or not. So, understanding your goods volume is key before deciding on FCL Container shipping.

Unlock hassle-free shipping

Struggling to decide between consolidation and a full container for your Malaysia-Luxembourg shipment? Let DocShipper, your expert freight forwarder, make it hassle-free. Our ocean freight professionals will guide you, taking into account factors such as cargo volume, urgency, and cost-effectiveness. Ready to simplify your shipping process? Reach out now for a free estimation of your shipping needs.

How long does sea freight take between Malaysia and Luxembourg?

On average, sea freight between Malaysia and Luxembourg takes anywhere from 22-35 days, with the precise time depending on a variety of factors. These factors include the exact ports used, the weight of the shipment, and the nature of the goods. For a tailored quote, we strongly suggest reaching out to freight forwarders like DocShipper.

Here's a glimpse at the average transit times for sea freight between the primary freight ports in both countries:

| Malaysia Port | Luxembourg Inland Port | Average Transit Time (Days) |

| Port Klang | Terminal de Conteneurs de Bettembourg | 30 |

| Port of Tanjung Pelepas | Terminal de Conteneurs de Bettembourg | 31 |

| Port of Penang | Terminal de Conteneurs de Bettembourg | 30 |

| Bintulu Port | Terminal de Conteneurs de Bettembourg | 33 |

*Please note, Luxembourg only has one multimodal freight terminal and no sea ports. Therefore all the transit times are calculated to this terminal.

How much does it cost to ship a container between Malaysia and Luxembourg?

Shipping a container from Malaysia to Luxembourg can range widely in cost, with ocean freight rates varying per CBM. The shipping cost depends on multiple factors, including your Point of Loading and Destination, the carrier chosen, the nature of your goods, and monthly market fluctuations. Unfortunately, an exact price isn't achievable due to these variables.

However, fear not; our shipping specialists are at your service, providing personalized quotes to match your specific needs and delivering the best cost-effective solution. Every consignment is unique, and we value each one, ensuring a smooth, cost-effective journey for your goods.

Special transportation services

Out of Gauge (OOG) Container

Definition: Out of Gauge or OOG containers are uniquely designed to accommodate cargo that doesn't fit into standard containers due to its dimensions. This includes especially tall, long, or wide items that exceed the standard dimensions. Suitable for: OOG is perfect for oversized goods such as machinery, construction materials, and large vehicles.

Examples: Imagine shipping construction equipment from Malaysia to Luxembourg; an OOG container would be your go-to option.

Why it might be the best choice for you: If your product cannot be disassembled or reduced in size and exceeds standard container dimensions, the OOG container ensures safe transportation while adhering to international shipping regulations.

Break Bulk

Definition: Break bulk refers to goods loaded individually, not in containers, onto a ship. This shipping method is used for cargo that is too big or heavy to be loaded into a container.

Suitable for: It can handle all sizes and weights, making it preferable for massive machinery, large vehicles, or building materials.

Examples: For instance, if you need to transport a large yacht or industrial turbines, consider break bulk shipping.

Why it might be the best choice for you: If you're shipping oversized or extremely heavy items that cannot be containerized, break bulk offers the flexibility you need.

Dry Bulk

Definition: Dry bulk shipping involves the transport of homogenous, loose cargo like coal, grain, or minerals in large quantities.

Suitable for: Dry bulk is used mainly for the transportation of dry, unpackaged goods.

Examples: It could be useful for you if you need to transport a large shipment of raw materials like gravel or coal.

Why it might be the best choice for you: If you're moving a massive quantity of dry, unpackaged goods, the dry bulk method offers a cost-effective and efficient mode of transport.

Roll-on/Roll-off (Ro-Ro)

Definition: Roll-on/Roll-off (Ro-Ro) refers to vessels designed to carry wheeled cargo like cars, trucks, trailers, and machinery that are driven on and off the ship on their wheels.

Suitable for: Ro-Ro is ideal for any wheeled cargo, whether it's an operational vehicle or equipment on a trailer.

Examples: For example, if you're exporting cars from Malaysia to Luxembourg, a ro-ro vessel would be the best choice.

Why it might be the best choice for you: If your cargo can be rolled on and off the vessel, Ro-Ro offers a convenient, secure, and efficient shipping option.

Reefer Containers

Definition: Reefer containers are refrigerated units for shipping goods requiring temperature control during transit.

Suitable for: They're suitable for perishable goods such as food, flowers, and pharmaceuticals.

Examples: For instance, imagine needing to transport fresh fruit from Malaysia to Luxembourg. In this case, you'd need a reefer container to maintain the necessary cool temperature.

Why it might be the best choice for you: If you're shipping perishable or temperature-sensitive goods, utilizing a reefer container ensures your products arrive in the desired condition.

In all these scenarios, regardless of your specific shipping needs, DocShipper is here to make your shipping experience smoother. Don't hesitate to contact us for a free shipping quote in less than 24h.

DocShipper Tip: Air freight might be the best solution for you if:

- You're pressed for time or facing a non-negotiable deadline. Air freight delivers unparalleled speed when it comes to transit times.

- Your shipment is modest in size, falling under 2 CBM. Air freight is particularly well-suited for these smaller consignments.

- Your supply chain includes destinations that are off the beaten maritime or rail paths. Air freight gives you access to a comprehensive global airport network.

Air freight between Malaysia and Luxembourg

When it comes to shipping valuables speedily and reliably between Malaysia and Luxembourg, air freight takes center stage. It's like the express train of the trade world, perfect for small, high-value items. Think luxury watches or intricate electronics.

But wait, there's more to it than meets the eye. Many businesses trip over stumbling blocks like improper weight estimation for their shipments, resulting in unexpected costs. It's like incorrectly guessing the weight of your suitcase before an international flight, and then being hit with an extra luggage fee. In this guide, we'll help you avoid these common mistakes, ensuring your shipping process is smooth sailing.

Air Cargo vs Express Air Freight: How should I ship?

Not sure whether to go air cargo or express for your next shipment from Malaysia to Luxembourg? Think of it this way: air cargo is like buying a seat onboard a commercial airline, while express air freight fast-tracks your goods on their very own dedicated plane. Let's delve into both options, to help align your shipping strategy with your business needs.

Should I choose Air Cargo between Malaysia and Luxembourg?

If you're planning to move 100/150 kg (220/330 lbs) of cargo from Malaysia to Luxembourg, air cargo is a sound choice. The upfront costs might be higher, but it offers reliability and cost-effectiveness over time. Airlines like Malaysia Airlines and Cargolux are key players in this sector offering scheduled services. While transit times might be longer due to fixed schedules, the trade-off is the reduced risk of damage or theft. Choosing air cargo could be the best balance for your budget and peace of mind.

Should I choose Express Air Freight between Malaysia and Luxembourg?

Express Air Freight, a premium service leveraging dedicated cargo planes with no passengers, effectively transports goods under 1CBM or about 100/150kg (220/330lbs) of cargo. This express service, provided by global courier firms like FedEx, UPS, or DHL, ensures quicker delivery times and extensive coverage, particularly useful for urgent or high-value shipments. If your commercial needs align with delivering smaller, high-priority goods from Malaysia to Luxembourg swiftly and reliably, this could be your optimal option.

Main international airports in Malaysia

Kuala Lumpur International Airport (KLIA)

Cargo Volume: KLIA handles over 1.8 million tons of cargo annually, making it the busiest cargo airport in Malaysia.

Key Trading Partners: The main trading partners are China, Singapore, Australia, Japan, and the USA.

Strategic Importance: KLIA's central location within Asia makes it a strategic hub for flights to and from this continent, Europe, and Oceania.

Notable Features: KLIA houses nearly 50 freight airlines and operates two runways capable of handling the world’s largest aircraft, the A380. The KLIA Free Commercial Zone offers facilities for high-value added, time-sensitive goods.

For Your Business: With regular cargo flights to most parts of the world and handling capabilities for multiple types of cargo, KLIA could be your ideal shipping solution, especially if your enterprise trades with Malaysia’s key partners.

Penang International Airport (PEN)

Cargo Volume: PEN supports over 360,000 tons of cargo per year.

Key Trading Partners: Penang mainly deals with import and export businesses in China, Japan, Singapore, India, and the EU.

Strategic Importance: Sitting at the northern part of Peninsular Malaysia, PEN serves as a major gateway to the northern part of the country and is important for regional logistics.

Notable Features: The airport houses several cargo agents and provides a Free Commercial Zone which benefits businesses with duty-free trading conditions.

For Your Business: If your business is focused on regional trade with Asian partners, taking advantage of PEN's prime northern location and well-equipped cargo handling facilities might enhance your logistics efforts.

Senai International Airport (JHB)

Cargo Volume: JHB handles close to 80,000 tons of cargo annually.

Key Trading Partners: The key trading partners are Singapore, Indonesia, and other ASEAN countries.

Strategic Importance: Located at the southern tip of Peninsular Malaysia, Senai Airport serves as a crucial entry point for goods headed to and from Southern Malaysia and Singapore.

Notable Features: The airport is equipped with a Free Zone, giving advantages for businesses trading internationally.

For Your Business: JHB's strategic location and free zone facilities present an excellent option if your business trades heavily with ASEAN countries and values duty-free, streamlined shipping.

Kuching International Airport (KIA)

Cargo Volume: Annually, KIA processes close to 22 million kgs of cargo.

Key Trading Partners: The primary trading partners include China, Japan, Singapore, and Australia.

Strategic Importance: As the fourth busiest airport in Malaysia, KIA services Borneo Island and is ideal for connecting trades between West Malaysia, Indonesian Borneo, and the Asia-Pacific region.

Notable Features: KIA is equipped to handle a variety of goods and also offers convenient access to the Pan-Borneo Highway for onward land transportation.

For Your Business: If your shipping needs involve Borneo Island or trade with Asia-Pacific countries, the services and location of KIA could be advantageous to your business.

Subang International Airport

Cargo Volume: Typically called Sultan Abdul Aziz Shah Airport or Subang Skypark, this airport manages about 700,000 kgs of cargo per year.

Key Trading Partners: Its key trading partners are primarily from ASEAN countries.

Strategic Importance: Located in the capital city of Kuala Lumpur, this airport is a major hub for corporate and private aviation in Southeast Asia.

Notable Features: The airport houses several cargo handling companies, has a dedicated Free Commercial Zone, and is well-linked to road networks.

For Your Business: If your enterprise handles a lower volume of high-value goods and targets domestic or ASEAN markets, Subang Skypark’s strategic location and excellent private cargo services might suit your requirements.

Main international airports in Luxembourg

Luxembourg Findel Airport

Cargo Volume: With an annual cargo volume of around 947,399 tonnes as of 2020, Luxembourg Findel Airport is an essential hub for business logistics in Europe.

Key Trading Partners: Mainly caters to significant trading partners such as Germany, France, and China.

Strategic Importance: As Luxembourg's only international airport, its strategic location at the heart of Europe makes it a preferred hub for multinational businesses looking to distribute goods efficiently within the continent.

Notable Features: It hosts one of Europe's largest all-cargo airlines, Cargolux, and provides state-of-the-art logistics facilities, including temperature-controlled warehousing for sensitive goods.

For Your Business: If your enterprise frequently ships to or from Europe, the Luxembourg Findel Airport should be under your consideration. Its expansive cargo handling capacity and comprehensive logistics solutions can provide your business with essential flexibility and efficiency.

How long does air freight take between Malaysia and Luxembourg?

Typically, air freight shipping between Malaysia and Luxembourg takes on average 3 to 5 days. However, this timeframe is subject to certain variables. The specific departure and arrival airports, the weight of your shipment, and the nature of your goods can significantly affect the transit time. To know the exact duration for your specific requirements, it's advisable to consult a reputable freight forwarder like DocShipper.

How much does it cost to ship a parcel between Malaysia and Luxembourg with air freight?

The cost of air freight shipment between Malaysia and Luxembourg typically ranges from $3 to $8 per kg. However, the exact price depends on numerous factors such as the distance from departure and arrival airports, parcel dimensions, weight, and nature of the goods. Rest assured, our experienced team is committed to working with you to provide the most competitive rates tailored to your requirements. We believe in quoting on a case-by-case basis to ensure fair and affordable pricing. Contact us and receive a free quote within 24 hours.

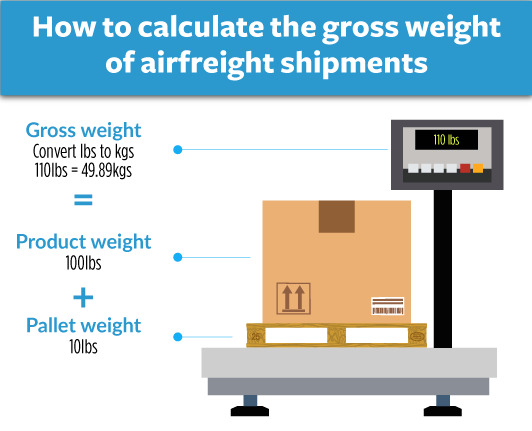

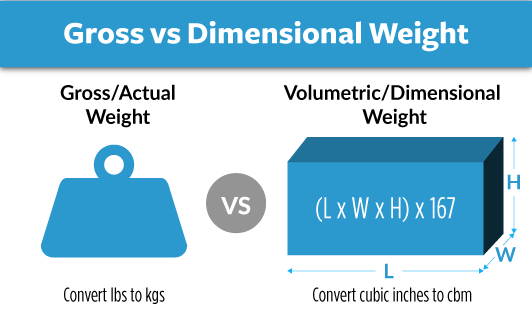

What is the difference between volumetric and gross weight?

Gross weight refers to the total weight of your shipment, including the packaging, pallets, and the goods themselves. On the other hand, volumetric weight considers the space your cargo takes up in the aircraft, providing a weight estimate based on the volume.

For Air Cargo service, volumetric weight is calculated by multiply the length (metre), width (metre), and height (metre) of each package in the shipment, then divide the total by 0.006. Say, for example, a shipment with dimensions of 0.5m x 0.5m x 1m gives a volumetric weight of 42kg (or approximately 93 lbs).

In Express Air Freight service, to get the volumetric weight, take the same three dimensions, but this time divide the total by 0.005. With the same example, this will result in 50kg (or approximately 110 lbs).

The gross weight, on the other hand, is simply weighing the package on a scale. Let's say our hypothetical shipment weighs 45kg (or around 99 lbs).

Now comes the crucial part: how does this affect your freight charges? Freight companies will charge based on the higher of the two weights - the gross or volumetric weight. It's their way of ensuring they're compensated fairly either for the actual weight of the shipment or for the space it occupies on their aircraft. So understanding these weights helps you anticipate your shipping costs.

DocShipper tip: Door to Door might be the best solution for you if:

- You value convenience and want a seamless shipping process, as door-to-door takes care of every step from pickup to delivery.

- You prefer a single point of contact, as door-to-door services typically provide a dedicated agent to handle all aspects of the shipment.

- You want to minimize the handling of your goods, reducing the risk of damage or loss, as door-to-door minimizes transitions between different modes of transport.

Door to door between Malaysia and Luxembourg

International 'Door to Door' shipping is like your personal courier - it takes your goods from point A in Malaysia, right to point B in Luxembourg. This shipping method is a time and effort saver, removing the need for you to manage multiple transportation stages. So, with clear advantages on our radar, let's dive into the depth of this process!

Overview – Door to Door

Wrestling with shipping woes between Malaysia and Luxembourg? Door to Door shipping could be your oasis in this logistics desert. It's a seamless, stress-free solution that softens the complexities of the process, with the added luxury of customs clearance included. Despite higher costs, its time efficiency and convenience make it a hit with our clients - think of it as a white-glove service for your shipping needs. However, do stay aware of potential import restrictions or duties at customs. Make Door to Door your strategy for a smoother, worry-free shipping experience.

Why should I use a Door to Door service between Malaysia and Luxembourg?

Imagine for a moment, doing a juggling act with your cargo—it's a tough gig, isn't it? That's where Door to Door service comes to save the day when shipping between Malaysia and Luxembourg. Here are five compelling reasons why:

1. Absolute ease: In Door to Door service, the freight forwarder takes charge right from picking up your goods to delivering them to the final stop. No more juggling tasks; we handle it all!

2. Reliability: With businesses needing more certainty, Door to Door shipping ensures a swift, timely delivery—making it a go-to for urgent consignments. Missed deadlines? Not on our watch!

3. Specialised care: Dealing with complex, sensitive cargo? Our expert handling ensures your freight gets the TLC it deserves, offering added peace of mind.

4. Complete oversight: With this service, you're not just outsourcing the logistics but also gaining an assurance that trucking, customs clearance, and other administrative duties are in expert hands. Say goodbye to sleepless nights over freight paperwork!

5. Convenience galore: By handling everything, from the first mile to the last, we provide a seamless shipping experience. No need to fret over coordinating with multiple agencies—enjoy the bliss of convenience!

So, if you’re keen on stress-free, ‘efficiency-first’ shipping, a Door to Door service might just be your golden ticket!

DocShipper – Door to Door specialist between Malaysia and Luxembourg

Experience seamless, hassle-free shipping between Malaysia and Luxembourg with DocShipper. Our expertise in global logistics ensures your goods are packed, transported, and cleared through customs with ease. Our dedicated Account Executives are ready to assist, providing all-encompassing solutions for any shipping method. Request a free estimate within 24 hours or consult with our experts at no cost. Rest easy, we've got you covered from A to Z.

Customs clearance in Luxembourg for goods imported from Malaysia

Customs clearance marks the critical part of international trade where goods are approved to enter or exit a country. Navigating the customs clearance landscape in Luxembourg for goods imported from Malaysia can be complex. Here, hidden charges can seep in unexpectedly and ignorance of certain rules like duties, taxes, quotas, and licenses could see your goods stuck at the border. It's essential to grasp these aspects to avoid costly delays.

Our guide ahead delves deep into these areas, providing insight and proactive solutions. Remember, at DocShipper, we're equipped to assist with all types of goods, worldwide. For a project estimate, simply touch base with our team along with your goods' origin, value and HS Code. These details are crucial to progress with the estimation. Your smooth shipping ledger is a click away!

How to calculate duties & taxes when importing from Malaysia to Luxembourg?

Before plunging into the complexities of trade lanes and tariffs, it's crucial to get acquainted with some fundamental factors that impact the estimation of duties and taxes when importing goods from Malaysia to Luxembourg. Central to this is understanding that the customs duty levied on your imports is largely determined by the country of origin, the Harmonized System (HS) Code of the goods, the Customs Value of the goods (usually the transaction value), the Applicable Tariff Rate, and any additional taxes or fees the goods might attract.

This process might seem daunting, but fear not. The journey begins with pinpointing the country where the goods you're transporting have been manufactured or produced. This step lays the groundwork for a smooth and efficient customs clearance process, helping you avoid unnecessary headaches down the line. So remember, knowing the origin of your goods is more than just a point on the globe, it's the starting line towards making your shipping process as seamless as possible. Let’s navigate this together!

Step 1 - Identify the Country of Origin

Identifying the country of origin is the critical first stride you must take when estimating duties and taxes. Here's why this step isn't negotiable:

1. Trade Agreements: Luxembourg and Malaysia have beneficial trade deals that could slash your customs duty costs.

2. Country of Origin Rules: The tariffs applied to your goods vary depending on their origin.

3. Import Restrictions: Products from some nations experience tighter regulations and checks than others.

4. Preferential Rates: Goods from countries with special trade agreements enjoy lower customs duties.

5. Import Licenses: The origin country could impact whether you need specific import licenses.

Luxembourg and Malaysia are part of the ASEM (Asia-Europe Meeting), promoting economic cooperation between Europe and Asia. Take advantage of this: understand the agreements to lower your import costs and smoothen the process.

In addition, Luxembourg places restrictions on certain imports from Malaysia, like animal products, plants, and high-tech goods. Better to check these rules out before you start shipping.

Remember, knowledge is power; the more you uncover about your product's origin country, the better you navigate through customs and save your company money in the process.

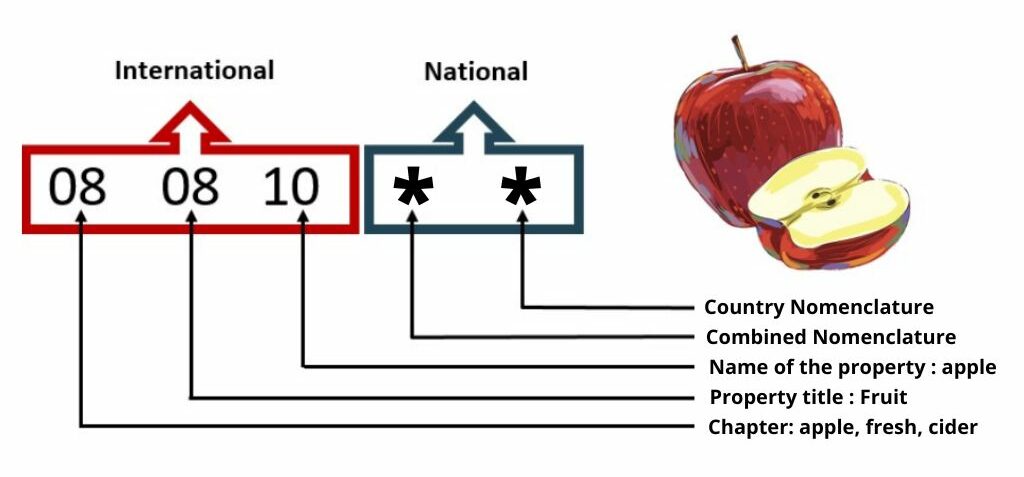

Step 2 - Find the HS Code of your product

The Harmonized System Code, often referred to as the HS Code, is a worldwide standardized system of names and numbers to classify traded products. Recognized universally, it serves an essential role in identifying products for customs declarations when goods are shipped internationally. The system is developed and maintained by the World Customs Organization (WCO), and its purpose extends beyond customs to tasks such as trade policy, monitoring, transport pricing, and economic research, to name a few.

Obtaining the correct HS code can often be as simple as asking your supplier. Given their familiarity with the products and the import rules and regulations, they are likely to have this information readily available.

However, if direct contact with your supplier is not an option, don't worry. We provide an easy step-by-step guide to find your product's HS code.

Step 1: Use an online HS Lookup tool. For instance, the Harmonized Tariff Schedule is an excellent example of such a tool.

Step 2: Input the name of your product into the tool's search bar.

Step 3: Once the search results are displayed, look at the 'Heading/Subheading' column, your HS code should be revealed there.

Please note, the correct identification of your product's HS code is of utmost importance. Inaccurate or incorrect codes could potentially lead to shipment delays and even fines. Accuracy is key to ensuring a smooth and effective customs clearance process.

To end, here's an infographic showing you how to read an HS code. It's a valuable tool in your arsenal for efficient international shipping procedures.

Step 3 - Calculate the Customs Value

Wondering about the customs value? It's the cornerstone of import duty calculation, and it's not quite the same as the value of your products. Think of it as a cocktail made of three ingredients: the price of your goods, the cost of international shipping, and the insurance cost. This concoction is known as the CIF value. For instance, if you're shipping electronics worth $1000 from Malaysia, and the shipping and insurance costs are $200 each, your customs value won't be just $1000. It will be $1400.

Understanding this fundamental concept gives you a solid head start in traversing the complex world of international logistics. It's like your navigation compass, directing your journey through customs clearance, and keeping you on the straight and narrow path towards success.

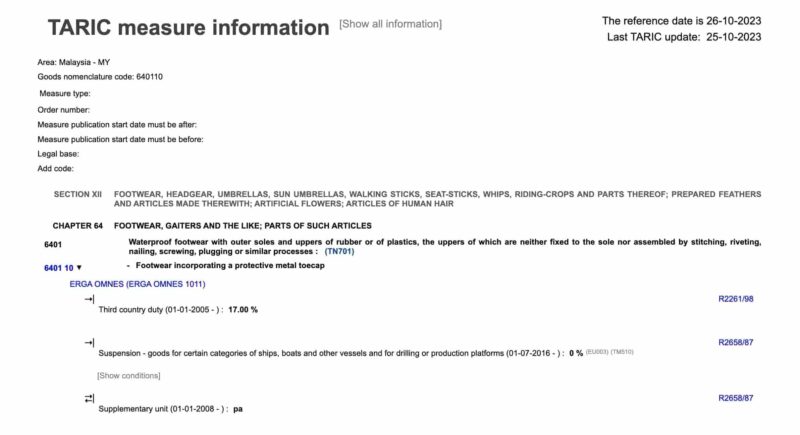

Step 4 - Figure out the applicable Import Tariff

An import tariff, also known as a customs duty, is a tax imposed on goods imported into a country. For goods imported from Malaysia into Luxembourg, which is part of the European Union, the type of tariff used is known as an ad valorem tariff. This tariff is calculated as a percentage of the Customs Value of the imported goods.

To determine the specific tariff for your product, you'll need to use the TARIC System - European Customs tool. Here's how:

1. Enter the HS (Harmonized System) code for your product, along with Malaysia as the country of origin.

2. The system will then display the duties and taxes applicable to your product.

For example, let's say you're importing rubber boots (HS code 640110) from Malaysia. You'd enter this HS code into the TARIC tool and select Malaysia as the origin country. The system may reveal an ad valorem tariff rate of 17%.

Now, let's assume your CIF (Cost, Insurance, and Freight) value is $10,000. The import duties would be calculated as 17% of this CIF value, which works out to $1,700.

This process of identifying applicable tariffs is crucial for understanding and managing your costs when importing goods. It also helps in ensuring compliance with customs regulations, helping you prevent unexpected costs or delays at the border.

Here's a detailed explanation of how to navigate the TARIC System website:

As you can see in the screenshot above, you must add your Goods Code (HS Code), and the country destination.

Once these are added, all you have to do is click on "Retrieve Measures" and it will lead you to your duties and taxes, here is what it looks like:

Step 5 - Consider other Import Duties and Taxes

After dealing with standard tariffs, it's crucial to evaluate whether other duties and taxes apply to your import. These can depend on several factors such as your product's origin and nature.

Consider the Excise Duty, typically charged on tobacco, alcohol, or energy products. If, for example, you're importing premium whisky from Malaysia, an Excise Duty may be levied. In a hypothetical situation, if the Excise Duty rate is 25% and the whisky costs $100, you'll need to pay an additional $25 in Excise Duty.

Then, there may be Anti-Dumping Taxes. These are designed to protect Luxembourg based industries from foreign competitors who sell goods below fair market price. Suppose you are importing steel products, and Malaysia is selling them at a lower price than Luxembourg market history, you may be hit with a hypothetical Anti-Dumping Tax.

Lastly, and crucially, is the VAT rate. Luxembourg's standard VAT is 17%, applied to the cost of goods plus any duties and taxes previously paid. For example, if your total cost (price + duties) comes to $125, a 17% VAT equals an additional $21.25.

Remember, these values are illustrative and actual rates might differ. So don't skip your homework and consult an expert if you're unsure!

Step 6 - Calculate the Customs Duties

Calculating customs duties can feel like a maze, but it needn't be a headache with the right guidance. Let's unravel it:

Duties are primarily calculated based on the customs value of your shipment, referred to as CIF (Cost, Insurance, Freight).

1. In a scenario where only customs duties apply, consider your shipment is valued at $10,000. With set customs duty at 10%, simply multiply: 10,000 x 0.10 = $1,000, your customs duty.

2. Add VAT into the mix, typically 17% in Luxembourg. Let's apply it to a $20,000 CIF shipment with a 5% customs duty. First, calculate duty: 20,000 x 0.05 =$1,000. Then, sum the CIF value and the duty (20,000 + 1,000) and calculate the VAT: 21,000 x 17/100 = $3,570.

3. For comprehensive calculation, consider anti-dumping taxes (20%) and Excise Duty (15%). On a $30,000 CIF (customs duties 5%, VAT 17%), first calculate customs duty: 30,000 x 0.05 = $1,500. Add $30,000 + $1,500 to get $31,500. VAT equals 31,500 x 17/100 = $5,355. Then, consider anti-dumping: 30,000 x 20/100 = $6,000. Finally, calculate the Excise Duty: 31,500 x 15/100 = $4,725. Add up all taxes for your total payable amount.

Weaves of calculations? Let DocShipper take the reins - from ensuring minimal charges to ensuring swift customs clearance worldwide, we've got you covered. Reach out for a free quote in less than 24 hours!

Does DocShipper charge customs fees?

DocShipper, with offices in Malaysia and Luxembourg, facilitates your shipping by handling customs clearances. We charge for this service, not for customs duties, which are levied by the government. Our invoices clearly differentiate our service charges from the customs duties. You'll receive documentation from customs verifying that all charges were necessary and correct, assuring you of total transparency. Your trust is paramount to us, so we'll ensure you're only paying what's due to the customs office. Think of it like dining out—our fee is the service charge; any taxes are paid directly to the government.

Contact Details for Customs Authorities

Malaysia Customs

Official name: Royal Malaysian Customs Department

Official website: www.customs.gov.my/en/

Luxembourg Customs

Official name: Customs and Excise Administration, Luxembourg

Official website: www.do.etat.lu/

Required documents for customs clearance

Unsure about the maze of paperwork for your shipment's customs clearance? We get it. In this section, we'll effortlessly break down essentials like the Bill of Lading, Packing List, Certificate of Origin, and those elusive Documents of Conformity. Breathe easy; we've got you covered.

Bill of Lading

When it comes to shipping goods from Malaysia to Luxembourg, you can't disregard the Bill of Lading. Think of it as your all-important shipping passport – a key document establishing the terms between shipper and carrier and marking the shift of ownership. As we embrace digitalization, consider the Telex (electronic) release. It's faster, reduces paperwork, and is more environmentally friendly.

Nonetheless, remember that for airfreight, an Airway Bill (AWB) is a must. It serves a similar function but is designed for air shipments. So, whether you're shipping electronics from Kuala Lumpur or importing fine wines into Luxembourg, having your Bill of Lading or AWB is essentially your first step towards a fuss-free customs experience. It’s that vital touchstone of successful cargo transport.

Packing List

Have you got an upcoming shipment from Malaysia to Luxembourg? If so, remember the one golden rule: Don't neglect your Packing List. To get your goodies smoothly through customs, accuracy is not optional; it's a requirement. The Packing List is your hero in declaring the precise details of your shipment—total weight, measurements, nature of goods, and more.

Ever imagined what might happen without one? The nightmare begins here, with your shipment being held up at customs, leading to unnecessary costs and delays. Imagine trying to decipher a haphazardly packed container with no guide—you wouldn't dream of it. Say you're shipping electronics. A detailed Packing List ensures those iPods don't mysteriously transform into iPhone 12s on the journey between Malaysia's sparkle and Luxembourg's charm. Keep this lifeline document accurate for both air and sea freight. Helpful hint: Always double-check the final copy.

Commercial Invoice

Navigating customs without a hitch calls for a well-prepared Commercial Invoice. When shipping from Malaysia to Luxembourg, this pivotal document works as your declaration to customs authorities, detailing crucial information about your goods — such as description, value, country of origin, and HS codes. Send a clear message to customs by ensuring the information syncs with your other shipping documents, like the Bill of Lading.

Picture it like this: you're shipping electronics and the Commercial Invoice shows a minor error in the product's HS code. This could lead to delays or unanticipated duties, throwing a spanner into your seamless shipping plans. Stay on top of your game, align your documents accurately, and keep customs clearance smooth sailing!

Certificate of Origin

Navigating through international shipping from Malaysia to Luxembourg? Then, a crucial part of your documentation is the Certificate of Origin. This isn't just about ticking a box, rather it may carve out for your business preferential customs duty rates.

Let me draw you a picture: Imagine you're exporting electronics made in Malaysia; a properly filled Certificate of Origin stating Malaysia as the country of manufacture can help cut down import duties in Luxembourg. It’s not just a paperwork formality but a money-saving tool, given the lower trade barriers between countries with certain trade agreements. So, ensure adding the Certificate of Origin to your document checklist – it's worth its weight in golden opportunities.

Certificate of Conformity (CE standard)

When shipping from Malaysia to Luxembourg, you'll need a Certificate of Conformity to the CE standard. Marking your goods with the CE standard signals that your products comply with European health, safety, and environmental protection standards. This is crucial for entry into Luxembourg, a European country where these regulations are heavily enforced. Unlike quality assurance which verifies the quality of your goods, a CE marking demonstrates conformity with legislative requirements of the EU market.

For context, think of it as similar to the FCC Part 15 certification in the U.S. If your shipment lacks this CE mark, your goods are at higher risk of being held up at customs, derailing your delivery schedules. To avoid such hiccups, ensure your products abide by the regulations and secure this certification before shipping. Keep in mind this is different in the UK where the UKCA marking is now required post-Brexit.

Your EORI number (Economic Operator Registration Identification)

If you're looking to ship goods between Malaysia and Luxembourg, an EORI number is vital. Not only used by the EU, this number is necessary for most countries when it comes to imports and exports. Think of it as your business passport for goods—it enables tracking of shipments for customs.

While the registration process is straightforward, not having an EORI will add significant delays to your shipping times. A real-world analogy would be queuing at the airport without an ID—you'll be in for a long wait. To mitigate this, ensure your business has an EORI number before initializing shipments. It's an essential step and a unique identifier for your business in the global supply chain. Remember, your EORI is your ticket to a smoother shipping experience.

Get Started with DocShipper

Tired of dealing with the complexity of customs procedures? Let DocShipper's international logistics experts take care of it all! From documentation to timely clearance, we ensure smooth transit for your goods from Malaysia to Luxembourg. Say goodbye to hold-ups and hello to efficiency. Get in touch now - we'll provide a free quote within 24 hours. Make your shipping experience seamless with DocShipper.

Prohibited and Restricted items when importing into Luxembourg

Ever been stuck scratching your head over what you can and can't ship to Luxembourg? Dealing with customs can feel like walking a tightrope. This guide delves into the do's and don'ts of Luxembourg's import restrictions, allowing you to ship confidently and avoid unwanted surprises.

Restricted Products

- Firearms and ammunition: To ship these, you'll need to secure an import license from the Grand Duchy of Luxembourg's Ministry of Justice.

- Pharmaceutical products: You need an authorization from the Ministry of Health to bring these into Luxembourg.

- Live animals and animal products: Before shipping, apply for permits with the Ministry of Agriculture, Viticulture, and Rural Development.

- Plants and plant products: For these, reach out to the Administration of Nature and Forests to get the necessary permits.

- Rough diamonds: Ship only after obtaining a Kimberley Process certificate from the Ministry of Economy.

- Artistic and cultural goods older than 50 years: For shipping these, contact the Ministry of Culture for a permit.

- Precursors to narcotics: you have to secure an import license from the Health Directorate.

- Goods subject to excise duties (alcohol, tobacco): To handle these, fetch an excise movement permit from the Luxembourg Customs and Excise Administration.

- Waste: All sorts of waste materials require an import permit, which you can obtain from the Ministry of Sustainable Development and Infrastructure.

Remember, always check the specific requirements and conditions for your product before shipping, as regulations can change frequently.

Prohibited products

- All kinds of narcotics and illegal drugs

- Substances: classified as psychotropic

- Weapons: of all types, including knives, guns, explosives, and other small arms, unless explicitly authorized

- Goods infringing on copyright laws: including counterfeit items or unauthorized replicas

- All items associated with human trafficking: including various forms of modern slavery and forced labor

- Harmful and toxic chemicals: not listed under controlled substances

- Endangered plants and animal species: including their by-products

- Radioactive materials and other hazardous waste products

- Obscene and immoral materials: explicit adult materials or content

- Anabolic substances and certain types of performance-enhancing drugs

- Pesticides and other harmful agricultural chemicals: banned within the European Union

- Genetically modified organisms: unapproved for import within the European Union.

Please note that this is not an exhaustive list and the regulations may change over time. Always make sure to confirm with the appropriate authorities when planning your shipment.

Are there any trade agreements between Malaysia and Luxembourg

Yes, there's a strong bilateral trade relationship between Malaysia and Luxembourg, but currently, no specific Free Trade Agreement (FTA) or Economic Partnership Agreement (EPA) exists. However, Malaysian exporters can benefit from the EU-Malaysia FTA talks that are set to resume. Additionally, Luxembourg's central location in Europe makes it a strategic gateway for Malaysian businesses looking to expand their market reach. Even slight shifts in these agreements or infrastructural projects can significantly impact your shipping costs and timelines.

Moreover, Malaysia and Luxembourg have agreed to possibly establish a joint business council to strengthen greater cooperation in areas such as trade, investment, finance, and banking. So, it's prudent to stay informed about these developments when planning your logistics.

Malaysia - Luxembourg trade and economic relationship

Tracing back to the early 90s, Malaysia and Luxembourg have nurtured a cordial economic relationship. Their collaboration has manifested in the financial sector, with Luxembourg being Malaysia's main gateway for investments in Europe. In contrast, Malaysia has been a catalyst in the growth of Islamic finance in Luxembourg.

The bilateral trade includes significant commodities such as electronic equipment, machinery, and palm oil from Malaysia, while Luxembourg exports iron and steel. As of 2021, the total trade volume exceeded MYR 1 billion, reflecting a 0.4% growth from the previous year. Also, in 2022, Luxembourg's imports from Malaysia were of $21.41 million. These figures testify to a partnership that continues to evolve amidst global economic shifts.

Your Next Step with DocShipper

Overwhelmed by the shipping process between Malaysia and Luxembourg? We understand the difficulties of international trade. From choosing the right transportation method to dealing with customs clearance, let DocShipper handle the complexities. Experience a stress-free shipping journey. Contact us today and step into a world of simplified shipping solutions.

Additional logistics services

Maximize your business efficiency as we unravel comprehensive logistics solutions! Discover how DocShipper's expertise covers your entire supply-chain process, well beyond shipping and customs clearance.

Warehousing and storage

Struggling to find the right storage for your diverse goods? Temperature-sensitive items demand equally sensitive warehousing solutions. Imagine, having a warehouse in Malaysia that meets all your needs – even those artisanal chocolates will stay crisp in transit. All this fuss can be avoided by choosing the right partner. Wondering how? Explore Warehousing for more insights.

Packaging and repackaging

When shipping from Malaysia to Luxembourg, the key to preventing freight damage lies in proper packaging and repackaging. Having a reliable partner to handle this can save you from costly damages or losses. Picture shipping fine porcelain articles or sensitive industrial parts - robust, tailored packaging can ensure that each product reaches its destination undamaged. Explore comprehensive details about this vital service on our page: Freight packaging.

Cargo insurance

Weathering overseas shipping mishaps is a breeze with Cargo Insurance. While fire insurance has you covered on land, our customized insurance policy lets you sleep easy, protecting your goods from port to port. For instance, uncovered losses due to rough handling at sea can become nightmare scenarios – prevent this! Mitigate your shipping risks today. More info on our dedicated page: Cargo Insurance.

Supplier Management (Sourcing)

Struggling to source and manufacture in Asia or East Europe? DocShipper has you covered. We unearth reliable suppliers and manage your entire procurement process. Language barriers? No worries, our supportive team is here to guide you. One recent success involved a textile company where we streamlined their supplier base, saving them precious time and money. More info on our dedicated page: Sourcing services.

Personal effects shipping

Moving precious belongings from Malaysia to Luxembourg? Ensuring the safety of fragile or bulky items is our top priority. Just like we've done for Ms. Wani's priceless porcelain collection, we'll handle your precious items with absolute care and adaptability. For a complete rundown, check out our detailed guide on Shipping Personal Belongings.

Quality Control

Quality control is your secret weapon when shipping from Malaysia to Luxembourg. It protects your bottom line against the high costs of re-shipments or returned goods due to poor quality. Imagine sending out a batch of customized tech devices, only to discover they're faulty upon delivery! Through our Quality Inspection service, speculative faults become a thing of the past as we ensure your products meet the precise standards before they're shipped. More info on our dedicated page: Quality Inspection.

Product compliance services

Ensure your shipment meets all required standards with our Product Compliance Services. Avoid delays and lost profit caused by non-compliance! Our team conducts precise lab testing to award certification, confirming your products align with destination regulations. Picture this: a denied shipment of electronics due to lack of CE certifications, causing a financial setback. To sidestep such issues, click here for Product Compliance Services.

FAQ | Freight Shipping between Malaysia and Luxembourg | Rates - Transit times - Duties and Taxes

What is the necessary paperwork during shipping between Malaysia and Luxembourg?

Shipping goods from Malaysia to Luxembourg involves a few key documents. We, at DocShipper, will take care of the bill of lading for sea freight or air way bill if you choose air freight. Meanwhile, on your end, you will need to keep ready a packing list and the commercial invoice. However, do note that depending upon the nature of your goods, additional paperwork, such as Material Safety Data Sheet (MSDS) and certain certifications, may be required. Our team will guide you at every step to ensure successful and smooth logistics operations.

Do I need a customs broker while importing in Luxembourg?

Yes, utilizing a customs broker when importing goods into Luxembourg is widely recommended. The process involves interacting with the customs authority, providing specific documents, and adhering to detailed procedures, all of which can be complex. At DocShipper, we'd be stepping in to represent your cargo at customs, simplifying and expediting the process for you. This service is routinely provided with the majority of our shipping arrangements. It ultimately frees you from dealing directly with the intricacies of customs, enabling you to focus on your core business operations.

Can air freight be cheaper than sea freight between Malaysia and Luxembourg?

While it can depend largely on specifics such as route, weight, and volume, we often suggest considering air freight when your cargo is less than 1.5 Cubic Meters or approximately 300 kg (660 lbs). This is because, under such circumstances, air freight may provide a competitively-priced solution. But remember, every scenario can be unique and different factors can influence the charges. Thus, we urge you to consult with your dedicated DocShipper account executive. With their assistance, you'll always be presented with the most cost-effective and efficient shipping option from Malaysia to Luxembourg.

Do I need to pay insurance while importing my goods to Luxembourg?

While shipping your goods to Luxembourg, or elsewhere, it's important to note that insurance isn't compulsory. However, we strongly advise opting for it. There are numerous potential incidents, from damage and loss to theft, which might compromise the integrity of your shipment. Having insurance can provide a vital layer of protection ensuring your goods are financially covered if an unplanned event occurs during transit. As your trusted freight forwarder, our team at DocShipper can guide you through the insurance process to ensure your goods are fully secured.

What is the cheapest way to ship to Luxembourg from Malaysia?

With the significant distance between Malaysia and Luxembourg, sea freight usually offers the most cost-effective solution. However, keep in mind that it also takes longer due to the vast geographical distance and extra handling. Combine this method with road delivery for last-mile transport upon arrival. We at DocShipper can tailor a sea-and-road solution based on your specific needs and help you optimize it for cost-effectiveness.

EXW, FOB, or CIF?

Indeed, your choice between EXW, FOB, or CIF hinges largely on the rapport with your supplier. Not all suppliers are logistics experts, so stepping in with an experienced freight forwarder like us at DocShipper is advisable. Typically, suppliers sell goods under EXW (right from their factory's doorsteps) or FOB (inclusive of all charges until the origin terminal). However, worry not! Regardless of the incoterm you choose, we offer a comprehensive door-to-door service, ensuring your shipment is handled professionally from start to finish. This helps keep uncertainties at bay and your goods moving smoothly across borders.

Goods have arrived at my port in Luxembourg, how do I get them delivered to the final destination?

If your goods have landed in Luxembourg under CIF/CFR incoterms, you'll need a customs broker or a freight forwarder to help with terminal clearance, import charges, and final delivery. However, if you'd prefer less hassle, with our DAP service, we at DocShipper will take care of it all. Remember to confirm these details with your dedicated account executive.

Does your quotation include all cost?

Absolutely, we include all costs in our quotation, ensuring transparency and no hidden fees for peace of mind. However, please note that our quotation does not cover duties and taxes at the destination. If you need an estimate for these, feel free to reach out to your dedicated account executive. This way, there will be no unanticipated costs.