If you need to import goods from Malaysia to the Philippines, you have come to the right place. On this page, you will find valuable information regarding international shipping from Malaysia. We'll provide you with essential details such as applicable regulations, customs procedures, air and sea freight options, and much more. All of this data has been carefully collected for you by Docshipper Malaysia.

Table of Contents

Which mode of transportation between Malaysia and the Philippines is the most efficient?

The choice of mode of transport between Malaysia and the Philippines depends on several factors, such as the nature of the goods, the delivery times required and the available budget. The two main options are air freight and sea freight. This guide will help you decide which mode of freight transport is best for you, as each decision has advantages and disadvantages.

Sea Freight from Malaysia to Philippines

DocShipper Tip : We are experts in freight transport. Do you need to ship your goods by sea? We are here and can take care of everything to save you time and money! Contact us via our form and make a free quote.

Shipping by sea freight from Malaysia to the Philippines offers an economical and reliable solution for transporting large or bulk cargo. With geographical proximity and close trade ties between the two countries, sea freight is a popular option for importing goods from Malaysia to the Philippines.

The main shipping seaports in Malaysia

- Port of Kelang

Kelang Port sits on the Strait of Malacca and holds a remarkable position as the 16th largest port in the world and the main port of Malaysia, spanning an area of 573 km2. Historically used as a transhipment port, it has benefited from the saturation of the port of Singapore, thus attracting many container ships. CMA-CGM has chosen to establish its main Asian distribution center in Kelang.

- Port of Tanjung Pelepas

Tanjung Pelepas Port, located near the mouth of the Pulai River, is Malaysia's largest container terminal. This port offers state-of-the-art, reliable and efficient services to major shipping lines and container operators, thus ensuring a substantial connection between shippers in Malaysia and the global market. It is a joint venture between MMC Corporation (70%), a utility and infrastructure company, and APM Terminals (30%), a leading global port organization paying 69 ports around the world.

The main shipping seaports in Philippines

The Philippines has several important ports for the transport of goods internationally.

Port of Manila: Located in the country's capital, the Port of Manila is the largest port in the Philippines. It is staffed by several people and is a major transshipment center for goods to and from other parts of the country.

- Port of Batangas: Located south of Manila, Port of Batangas is the second largest port in the Philippines. It is well connected to the southern provinces of Luzon and also serves popular tourist destinations such as Puerto Galera.

- Port of Cebu: Located in Cebu City in the central region of the Philippines, Port of Cebu is a major port serving the Visayas and Mindanao regions. It is also an important entry point for tourist cruises.

- Davao Port: Located in Davao City, Mindanao Region, Davao Port is the largest port in the southern Philippines. It is essential for the export of agricultural and mining products from the region.

- Port of Subic: Located in Zambales province, northwest of Manila, Port of Subic is a former site of the US naval base turned into a special economic zone. It offers modern facilities for international trade and a holding of foreign investments.

Transit time between Malaysia and the Philippines

| Philippines /Malaysia | Port of Kelang | Port of Tanjung Pelepas |

| Port of Batangas | 10 days | 10 days |

| Port of Cebu | 7/8 days | 7/8days |

| Davao Port | 10 days | 10 days |

| Port of Subic | 7/10 days | 7/10 days |

Please note that the previously mentioned transit time does not only include the period during which the cargo is in transit. It is important to take into account additional steps such as collection, delivery, loading and unloading, which are not included in this period and can lengthen the total duration of your shipment.

DocShipper Alert : By opting for sea freight, you will benefit from savings compared to air freight, but it is important to note that this involves a longer delivery time. Sea freight is an ideal solution when you can wait to receive your goods. For more information and to request a quote, do not hesitate to contact us via our online form or call us directly!

Do I have to ship by groupage or full container between Malaysia and Philippines ?

There are three standard container sizes that are widely used for personal and business travel. These containers are also frequently used by traders for the transport of solid samples. Sizes include:

- 40ft High Cube Container (76 cubic meter capacity): This type of container provides extra height over standard containers, maximizing cargo space.

- 40ft container (67 cubic meter capacity): This container is a standard size and is a popular option for transporting medium to large sized cargo.

- 20ft container (33 cubic meter capacity): This is the most compact container of the three options, ideal for smaller shipments or when cargo space is limited.

Less than Container Load (LCL)

When you need to ship products that don't fully become a container in terms of size or quantity, LCL (Less than Container Load) shipping is a great option. This method allows you to only pay for the space actually used, making it ideal for smaller mailings. Your goods will be consolidated with those of other shippers moving in the same direction, which can share transportation costs and make shipping more economical.

Advantages of LCL

- If your items take up space between 2 CBM and 12/15 CBM, shipping by LCL is the most economical option in terms of volume. This helps reduce packaging and quality control costs.

- Unlike air transport, which has certain restrictions, LCL shipping allows all types of products to be transported.

The disadvantages of LCL

- For shipments over 13 CBM, the packing, loading and unloading of an FCL (Full Container Load) may be repaired. In our experience in Malaysia and throughout Asia, we find that the FCL option is more economical and reasonable in these cases.

Full Container Load (FCL)

FCL (Full Container Load) offers the advantage of allowing a single shipper to use the entire container, from time of departure to time of arrival.

The container is sealed as soon as it leaves the company until it is delivered to the customer, thus the risks and costs.

It is an ideal choice if you intend to purchase a large number of products. Whether you completely fill the container or not, the optimal use of FCL is more secure and less expensive for a larger volume. Indeed, from 15 m3, a full container can be more economical than the LCL option.

The benefits of FCL shipping

- FCL is the most cost-effective transportation option due to its capacity exceeding 16 CBM.

- Taking charge of your goods' packaging becomes convenient as palletization is not required. With reduced cargo handling, you can experience increased security and lower risk of damage during loading, interim storage, and unloading.

The drawbacks of FCL

- You should only consider FCL if the volume meets certain criteria.

- Specifically, it should range from 40% to 70% of a 20-foot container or correspond to sizes such as 13, 14, 15, and 20 MH.

Special maritime transport between Malaysia to Philippines

The assistance you require will depend on the size and weight of your goods. If you have specific items, consider the following information:

Reefer container: A cold container that maintains a specific temperature regardless of weather conditions.

Ro-Ro: Roll-on/roll-off ships designed for transporting wheeled items such as cars, trucks, and trailers that can be driven on and off the ship.

Bulk: Delivery of supplies in bulk directly into the ship's hold, commonly used for transporting items like sand, aggregates, grain, and minerals.

OOG (Out of Gauge): Freight that exceeds standard measurements, divided into accessible and plain stack containers.

Open Top Containers are used for shipping finished items that require forklift handling and loading.

Docshipper Tip : For international trade involving Malaysia, ocean cargo is the preferred shipping method due to its cost-effectiveness for long-distance and large-volume shipments. If you have questions about heavy lifting or other types of goods, the experts at DocShipper are available to provide you with the best solutions. Contact us to learn more and receive personalized assistance.

How much does it cost to ship from Malaysia to the Philippines?

The cost of shipping from Malaysia to the Philippines depends on several factors such as weight and dimensions of the cargo, mode of transport (sea, air, land), distance, additional services needed, customs regulations, exchange rates, taxes and handling charges. Shipping rates are usually determined by carriers and shipping companies.

For shipments under 15 cubic meters, an LCL (Less Than Container Load) is preferable to an FCL (Full Container Load). Our experts will help you make the best decision based on your specific needs.

The final cost will depend on your needs and our ability to provide packing and loading services. The weight and quantity of the products transported influence the cost of sea freight. The weight/volume ratio is generally calculated according to the equivalent rule: 1 m3 per ton.

Groupage and traditional modes of transport are well established. The carrier will always choose the higher value between weight and volume to calculate the costs.

DocShipper Alert :Proper packing is essential for the safety of your goods during transit. Don't underestimate its importance just because it incurs additional costs. To learn more about our packaging services, speak to our shipping specialists or visit our dedicated page on packaging services.

Tariff Supplements:

Marine tariff surcharges are additional costs imposed by maritime transport companies on top of the agreed party-agreement rate. These surcharges vary depending on the context.

The pricing of marine freight transit is complex and influenced by various factors.

BAF (Bunker Adjustment Factor) is a surcharge that reflects changes in crude oil prices. It was introduced during the 1973 oil crisis and has remained relevant due to the fuel consumption of modern ships.

CAF (Currency Adjustment Factor) is a fee that accounts for fluctuations in the value of the dollar. As most ocean freight rates are calculated in US dollars, this surcharge helps mitigate currency risks for companies.

THC (Terminal Handling Charge) represents the handling costs at the loading and unloading ports. For containerized cargo, the charge is often fixed per container, while for non-containerized freight, it may vary based on weight or size, with additional surcharges for excessive dimensions or weight.

Air freight shipping between Malaysia and Philippines

DocShipper Recommendation : Air freight is the best option for shipments under 2 CBM requiring fast delivery.

DocShipper Tip : Are you looking for prices and/or advice on air freight ? Feel free to contact our experts by filling out our online form.

Air freight between Malaysia and the Philippines is a fast option for delivering your goods, although the cost is higher than other modes of transport. The two countries are geographically close, which allows fast delivery times. Air freight offers advantages such as fast delivery, increased security of goods and efficient management of deadlines. However, it should be noted that air freight may be subject to weight and size restrictions for the goods transported.

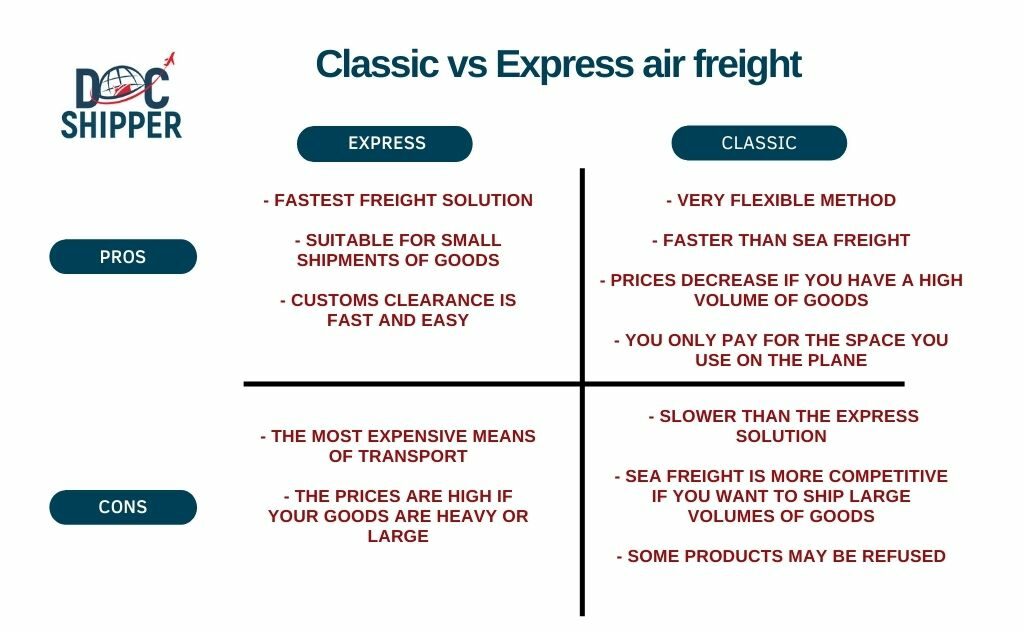

Classic or Express air freight

There are two types of air transportation available for shipping:

- Traditional air freight: This method utilizes the cargo space on regularly scheduled flights operated by airlines such as British Airways, Air China, Thai Airways, and Qatar Airways.

- Express air freight: This option is more expensive but offers faster delivery. It involves using dedicated aircraft designed for air freight, and courier companies like UPS, FedEx, TNT, and DHL handle the door-to-door services, including pick-up from the aircraft and final delivery to the customer. With this method, goods can be hand-delivered to any location worldwide.

Main Malaysian airports :

- Malacca International Airport

- Sultan Abdul Aziz Shah International Airport

- Penang International Airport

- Kuching International Airport

- Kota Kinabalu International Airport

- Langkawi International Airport

- Miri Airport

Main Philippines airports

- Manila Ninoy Aquino International Airport (MNL)

- Mactan–Cebu International Airport (CEB)

- Clark International Airport (CRK)

- Davao International Airport (DVO)

- Zamboanga International Airport (ZAM)

- Subic Bay International Airport (SFS)

The transit time between Malaysian and Philippines airports

The average transit time between airports in Malaysia and the Philippines varies depending on several factors such as the airline, weather conditions and flight availability. In general, the direct flight time between the two countries is around 3 to 4 hours.However, it is important to take into account check-in times, security procedures and possibly layovers, which can add some overtime.

How much does air freight between the Philippines and Malaysia cost?

The cost of air freight between the Philippines and Malaysia varies depending on several factors such as weight, size, nature of the goods, the airline used, additional services requested, etc. Due to this variability, it is difficult to give an accurate average number without more specific information about your shipment.

However, to give you a rough estimate, the cost of air freight between the Philippines and Malaysia can usually range between 2 and 10 US dollars per kilogram. Please note that this does not include any additional charges such as handling fees, customs duties or special charges related to certain goods.

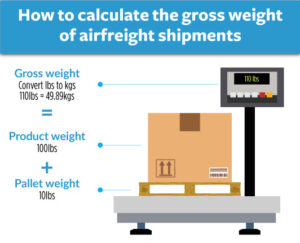

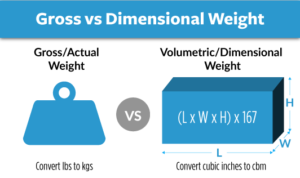

What distinguishes volumetric weight from gross weight?

The freight rates for traditional and express air freight are calculated differently. Traditional freight uses a weight band rate that decreases as the weight of the items increases. On the other hand, express freight charges are based on the volume of goods shipped and are calculated at each step of the shipping process. The carrier determines the rate based on the higher value between the gross weight and the volumetric weight.

The volumetric weight is calculated as follows: 1 cubic meter is equal to 167 kilograms for conventional air freight and 200 kilograms for express air freight.

If the volumetric weight exceeds the actual weight of your shipment, the carrier will provide a quote based on this weight. You can utilize online load weight calculators to simplify the process once you grasp the concept.

DocShipper Tip: With our strong partnerships with global cargo carriers, we provide highly competitive rates for air cargo services between Malaysia and the Philippines. Whether it's regular or courier air freight, or even truckload services, we can deliver your goods to your desired location. Contact us for a quick quote within 24 hours.

Custom Clearance in Malaysia

In Malaysia, customs clearance for your goods requires a comprehensive invoice and air waybill. Additional authorization or licenses may be required by the authorities for controlled, restricted, or prohibited items.

To ensure your products are cleared and available in Malaysia, all tariffs and taxes must be paid. Clearance of cargo may occur before arrival, but if there are any issues with your products or documents, the shipment may be held for 24 to 48 hours upon arrival for further resolution. It is important to comply with customs regulations and provide accurate documentation to avoid any delays or complications.

Custom Clearance in Philippines

Customs clearance in the Philippines involves several steps to allow legal entry of goods into the country. First, the required customs documents must be presented to the customs authorities. Next, the goods are subject to customs valuation, where their tariff classification and the determination of applicable duties and taxes are made. After that, duties and taxes must be paid before the goods can be cleared. Finally, once all the necessary procedures and payments have been completed, the goods are allowed to enter and be delivered to their final destination. It is essential to comply with Philippine customs regulations and provide accurate documentation to facilitate the customs clearance process and avoid any delays or problems.

What are the customs duties and taxes?

Customs duties and taxes in the Philippines vary depending on the nature of the imported goods.

Customs Duties: Customs duties are taxes imposed on imported goods. The rate varies according to the tariff classification of each product, which is determined by the Harmonized Commodity Coding System. The rate can vary from 0% to higher rates, depending on the type of product.

Value Added Tax (VAT): VAT is a tax based on the value added of a good or service at each stage of the supply chain. In the Philippines, the standard VAT rate is 12%. However, certain basic products may be exempted or benefit from a reduced rate.

Tax on petroleum products (TPP): The TPP is a specific tax imposed on imported petroleum products. TPP levels vary depending on the type of petroleum product.

Other taxes and charges: There may be other taxes and charges such as environmental tax, liquor and tobacco tax, motor vehicle tax, etc. The rates and methods of calculating these taxes may vary.

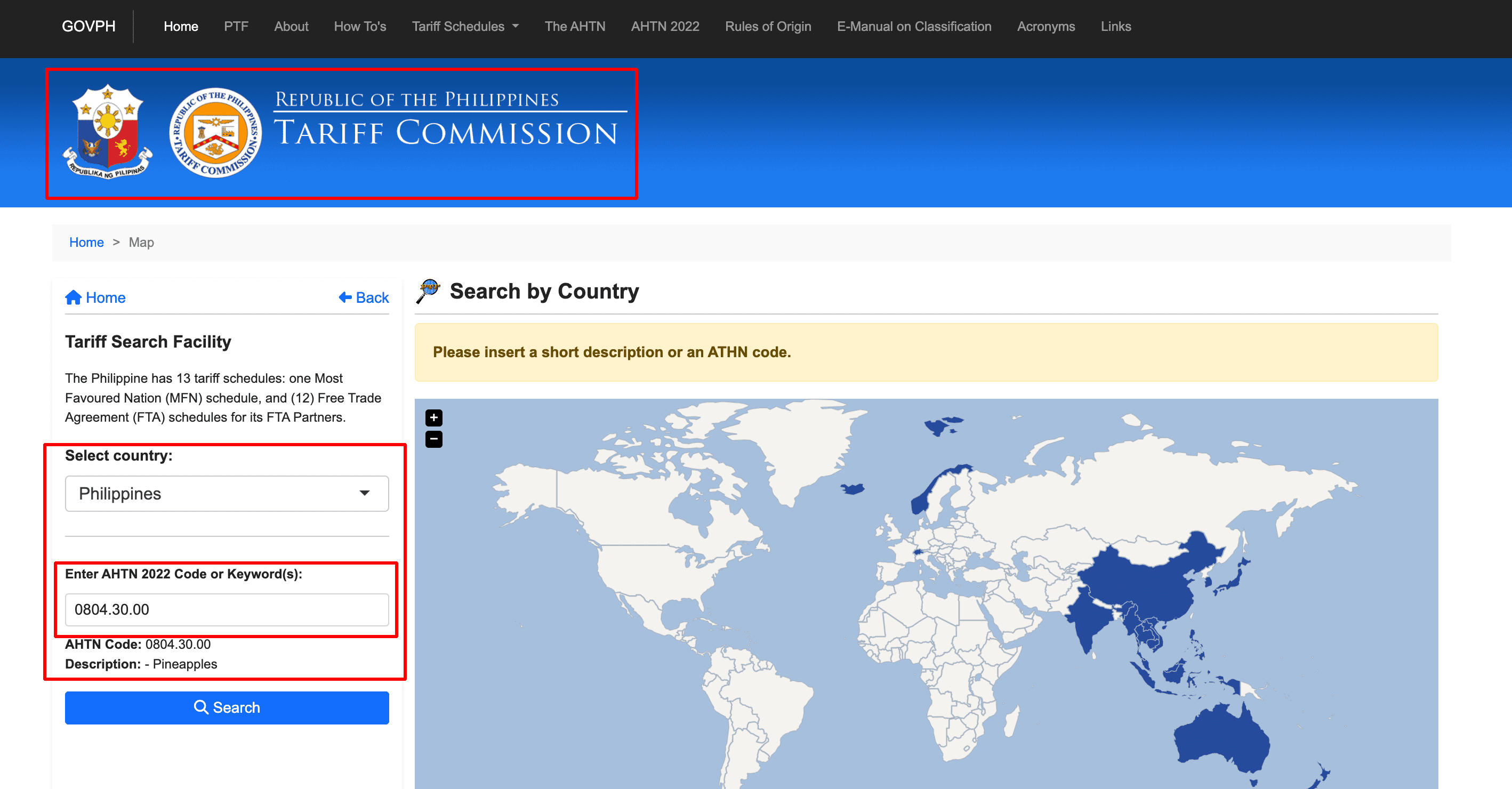

How to get your HS code?

To determine the correct HS Code for your goods, you have several options. One of the first steps is to consult with your supplier or provider, as they should have knowledge and expertise in classifying products.

Alternatively, you can visit the HTS (Harmonized Tariff Schedule) or AHTN (the asian HS code)code locator webpage, which provides a user-friendly interface for searching and identifying the appropriate HS code for your specific product.

As an example, let's consider the word "pineapple" to demonstrate the process. Firstly, enter the name of the country that you are interested in and secondly, enter the word "pineapple" in the research bar under the "select country" part. That's it!

Have you already determined the HS Code for your products? You can find the specific tariff rates applicable to your goods on the official website. However, please note that the website (https://finder.tariffcommission.gov.ph/search-by-country) is currently accessible. Moreover, it is recommended to directly consult with our experts at DocShipper for accurate and up-to-date information regarding duties and taxes in Malaysia based on your HS code. For additional details, you can also visit the official Customs website in Malaysia.

How to calculate customs duties and taxes?

To calculate the customs duty, you need to consider the total value of the imported goods, any applicable consumption tax, environmental protection rate, and tax rate.

The VAT (Value Added Tax) is calculated by multiplying the total cost of the imported goods plus the import tax by the applicable VAT rate.

For the special consumption tax, you simply multiply the value of the product by the relevant SCT rate.

The environmental protection tax is calculated by multiplying the quantity of taxable commodities by the EPR rate.

To determine all applicable taxes for importing into Malaysia, you need to add VAT, any applicable TCS (Tariff Classification and Statistics), and import taxes to the EPT (Environmental Protection Tax), if applicable.

Does Docshipper charge duty?

We do not accept payment for customary duties. Instead, we will provide you with the necessary information provided by Malaysian Customs. The only costs that may be incurred are those associated with the preparation of regulatory documentation, which will be exempted. At DocShipper, we will handle the collection of these customs leniency costs as we will be responsible for preparing the required documentation. The government will be responsible for collecting any customs-related fees.

DocShipper Alert :It is common to encounter substantial additional taxes upon the completion of your import process. It is crucial to have comprehensive knowledge about all applicable taxes. For detailed information, we recommend contacting Docshipper.

Official customs contacts

Malaysian Customs

Official Name : General Directorate of Customs of Malaysia

Website : Malaysian customs

Required documents

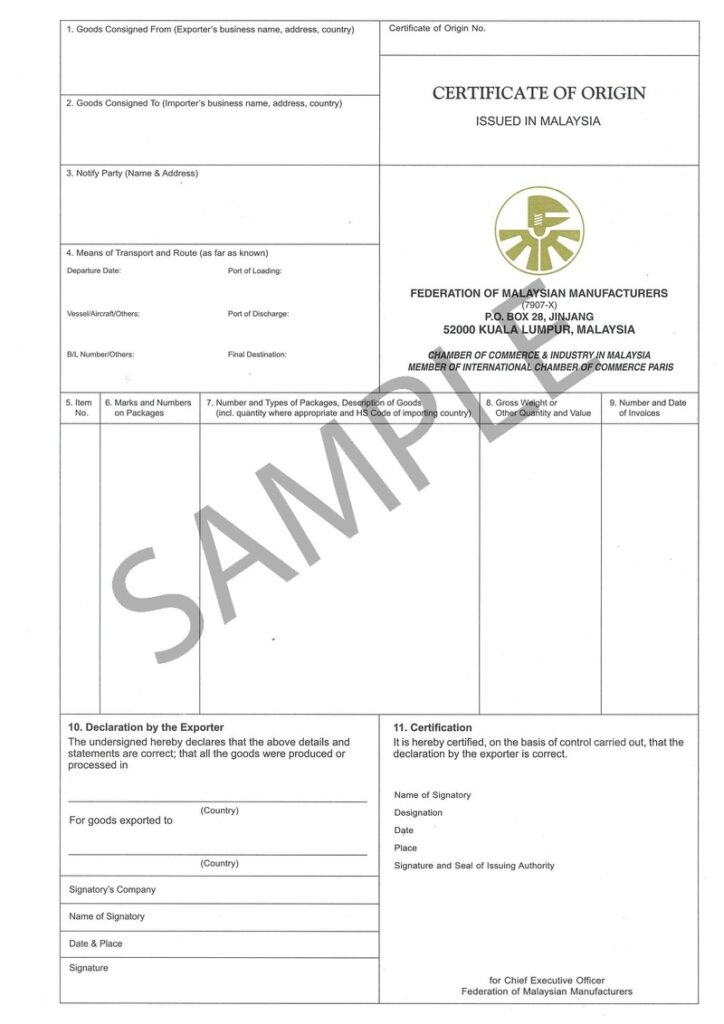

Certificate of Origin

The certificate of origin is a document that verifies the country of origin of the transported goods. It specifies the country where the goods were manufactured, which should not be confused with their place of origin. This document is essential for international trade.

Bill of lading

The bill of lading is a transportation document that serves as proof of delivery of the goods by the exporter. It is a legally significant document that provides all the necessary information for proper handling and invoicing of the freight.

Original invoice

The original invoice is a crucial document required for customs clearance in both Malaysia and Philippines. It is important to ensure that the amount stated on the original invoice matches the information on the packing list.

Packing list

A packing list is an essential document created by shippers for all parties involved in the supply chain. It contains detailed information about the products and packaging included in each shipment. This document is required for both air and sea freight shipments.

Health certificate

A health certificate is a document that verifies compliance with specific criteria established by legislation regarding production hygiene, microbiological standards for food products, and animal health. It is issued after an inspection by competent authorities.

If you are looking to import items falling under these categories, we recommend contacting our experts at DocShipper. They will provide guidance and assistance throughout the entire import process.

Our additional services

Warehousing and storage

DocShipper offers strategically located warehouses to cater to your storage needs for exporting goods. Whether you require short-term or long-term storage, our warehouses are equipped to handle your products efficiently. We also provide container optimization strategies, allowing you to consolidate or distribute goods based on your requirements.

Visit our specialty page at Warehousing

Packaging and repackaging

Don't underestimate the importance of packaging and preparation to ensure the safety and protection of your products during shipping and storage. At DocShipper, we offer a wide range of packaging materials such as pallets, cartons, boxes, tape, and bubble wrap to meet your business needs.

More details on our specialized page: packing service

Cargo insurance

Cargo insurance costs vary based on factors such as the type of vehicle, the nature of the goods, and the insurance provider. It is important to note that the declared value can be increased by up to 20% to account for potential damages. In addition to covering the transportation expenses, cargo insurance also protects the value of the goods being transported.

For more information about our insurance services, please visit our dedicated page: insurance services

Moving service

Planning a trip to Malaysia? Whether you're traveling for leisure or relocating, you may need assistance with moving your belongings. Our moving services cover everything from packing and handling to customs inspections, ensuring that your items are delivered to your destination in optimal condition. Our team of professionals will take care of all the necessary arrangements, regardless of your location in the world.

For more information, please visit our dedicated page: Moving Assistance.

FAQ | Freight between Malaysia and the Philippines | Rates - Transit Times - Duties & Taxes

Are there any special package labeling requirements for freight between Malaysia and the Philippines?

Yes, there are special package labeling requirements for freight between Malaysia and the Philippines. These requirements may vary depending on the type of goods and the customs regulations in force. As a logistics expert, DocShipper can provide you with detailed advice on specific labeling requirements to ensure a smooth and compliant shipment between these two countries.

Which mode of transport will be cheaper, air freight or sea freight?

Sea freight will definitely be cheaper than air freight, even though air freight is faster. DocShipper can help you choose the most economical mode of transport according to your specific needs.

What are the restrictions or special permissions for shipping certain products between Malaysia and the Philippines?

Product restrictions and special permissions for shipping certain items between Malaysia and the Philippines depend on the type of product. Specific regulations may apply to sensitive products such as food, chemicals, drugs, weapons, etc. It is important to check the rules and requirements of customs authorities in both countries to ensure compliance when shipping these products.

DocShipper info: Do you like our article today? For your business interest, you may like the following useful articles :

DocShipper | Your dedicated freight forwarder in Malaysia !

Due to our attractive pricing, many customers trust our services and we thanks them. Stop overpaying the services and save money with our tailored package matching will all type of shipment, from small volume to full container, let us find the best and cost-effective solution.

Communication is important, which is why we strive to discuss in the most suitable way for you!