As we all know the process of moving goods from one country to another, whether it is export or import, is somehow stressful and complicated for beginners and requires a lot of administrative procedures and documents, one of the most important of those is the letter of credit.

In this article, we will give a detailed explanation of the letter of credit, its role and how to get it.

DocShipper Alert : DocShipper Group is an international freight forwarder that helps SMEs and individuals at every stage of the supply chain across 5 continents. So if you plan to order goods from abroad and ship them, we will take care of the whole procedure, formalities and planning. Just sit back and let us take care of everything.

To contact us please fill out this form or get immediate answers by calling our experts.

Table of Contents

What is a Letter of Credit ?

A letter of credit (L/C), also known as "documentary credits (D/C)" is simply a means of payment widely used in international trade.

It is an agreement in which the bank, on behalf of the client (usually the importer), takes over the payment for goods and services ordered by the latter to a third party (usually the exporter) by a given date.

The parties involved in a letter of credit transaction :

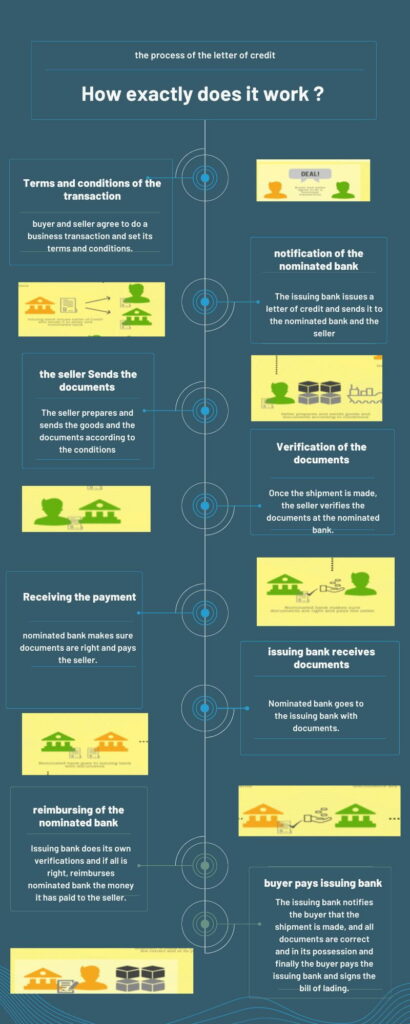

There are typically four parties involved in a letter of credit transaction:

- The Applicant (Buyer) - the party who wants to purchase goods and requests a letter of credit from their bank.

- The Issuing Bank - the bank that issues the letter of credit at the request of the applicant and on behalf of the applicant's bank.

- The Beneficiary (Seller) - the party to receive payment under the letter of credit.

- The Advising Bank - the bank that advises the beneficiary of the letter of credit and verifies that the terms and conditions have been met. This bank may or may not be the same as the issuing bank.

Each party plays a specific role in the transaction, and the success of the transaction depends on the cooperation and fulfillment of obligations by all parties involved.

What are the advantages of using a letter of credit ?

A letter of credit provides several advantages to the parties involved in a trade transaction, including :

- Reduced Risk of Non-payment: A letter of credit provides a guarantee of payment from a reputable bank, reducing the risk of non-payment for the seller and increasing the trust in the transaction for the buyer.

- Improved Cash Flow: The seller can receive payment under the letter of credit before delivery of the goods, improving their cash flow and allowing them to finance the production and shipment of the goods.

- Increased Flexibility: A letter of credit can be structured to meet the specific needs of the transaction, including flexible payment terms and the ability to adapt to changes in the market.

- Reduced Documentation Requirements: The letter of credit can simplify the process of documenting the transaction, reducing the number of documents that need to be prepared and transmitted between the parties.

- Improved Security: A letter of credit provides a secure method of payment that reduces the risk of fraud and helps to ensure that the terms of the transaction are met.

- Increased Confidence: A letter of credit provides increased confidence to the parties involved in the transaction, as they know that payment will be made in accordance with the terms and conditions of the letter of credit.

Overall, a letter of credit is a useful tool for reducing the risks and improving the efficiency of international trade transactions, and it can help to build stronger relationships between buyers and sellers.

DocShipper info :

At DocShipper, we safeguard our clients against all kinds of frauds that could occur starting from finding a trustworthy supplier to quality control and cargo insurance.

To get more information about our services and protect yourself from fraud please fill out this form or get immediate answers by calling our experts.

The 7 main types of a Letter of Credit :

There are several types of letters of credit, including:

- Revocable Letter of Credit: A revocable letter of credit can be amended or canceled by the issuing bank without prior notice to the beneficiary.

- Irrevocable Letter of Credit: An irrevocable letter of credit cannot be amended or canceled without the agreement of all parties involved, including the issuing bank, the beneficiary, and the applicant.

- Confirmed Letter of Credit: A confirmed letter of credit is guaranteed by both the issuing bank and another bank, typically located in the beneficiary's country. This provides additional security for the beneficiary.

- Unconfirmed Letter of Credit: An unconfirmed letter of credit is only guaranteed by the issuing bank, and there is no additional bank guaranteeing payment.

- Sight Letter of Credit: A sight letter of credit requires the beneficiary to present the required documents and request payment as soon as the goods have been shipped, or the services have been performed.

- Deferred Payment Letter of Credit: A deferred payment letter of credit allows for payment to be made at a later date, after the goods have been shipped or the services have been performed.

- Standby Letter of Credit: A standby letter of credit is a secondary source of payment that acts as a guarantee of payment in case the applicant is unable to fulfill their obligations under the terms of the transaction.

Each type of letter of credit has specific advantages and disadvantages, and the choice of the kind of letter of credit will depend on the specific needs of the transaction and the parties involved.

How to get a Letter of Credit ?

To obtain a letter of credit, the following steps are typically involved:

- Step 1: Determine the need for a letter of credit

A letter of credit is typically used when the buyer and seller are from different countries, or when the buyer wants to reduce the risk of non-payment by the seller.

- Step 2: Find a bank

The buyer needs to find a bank that will issue the letter of credit. This can be the buyer's own bank, or a specialized trade finance bank.

- Step3: Submit an application

The buyer submits an application to the bank, specifying the details of the transaction, including the amount of the letter of credit, the goods being purchased, and the conditions that must be met.

- Step 4: Negotiate the terms

The bank and the buyer negotiate the terms of the letter of credit, including the documents that must be provided, the shipment terms, and the expiration date of the letter of credit.

- Step 5: Provide collateral

The bank may require the buyer to provide collateral, such as a cash deposit or a guarantee from another bank, to secure the letter of credit.

- Step 6: Obtain the letter of credit

Once the terms have been agreed upon and the collateral has been provided, the bank issues the letter of credit and sends it to the seller or the seller's bank.

- Step 7:Use the letter of credit

The seller ships the goods and presents the required documents to the bank, which verifies that the conditions of the letter of credit have been met. If the conditions are met, the bank pays the seller or releases the shipment to the buyer.

It is important to note that the process of obtaining a letter of credit can be complex and time-consuming, and it may involve additional steps and parties, depending on the specific terms of the transaction.

DocShipper info: At Docshipper we make the complicated and time-consuming process of customs clearances easy and simple for you. All you have to do is get in touch with us, and we'll take care of everything so that your products arrive at your door without you having to do a thing.

Dont hesitate to contact us by filling out this form or you get immediate answers by calling our experts.

What are the documents required for a letter of credit?

The documents required for a letter of credit will depend on the specific terms of the transaction and the type of letter of credit, but typically include the following:

- Commercial Invoice: a commercial invoice is a document that provides details of the goods or services being purchased, including the quantity, unit price, and the total amount.

- Bill of Lading: A bill of lading is a document that serves as a receipt for the goods being shipped and as a contract of carriage between the seller and the carrier.

- Packing List: A packing list provides details of the contents of the shipment, including the quantity and type of goods being shipped.

- Insurance Document: An insurance document, such as an insurance policy or certificate, provides evidence of insurance coverage for the cargo being shipped.

- Inspection Certificate: An inspection certificate, such as a quality control certificate or a weight certificate, provides evidence that the goods have been inspected and meet the required standards.

- Shipped-on-Board Bill of Lading: A shipped-on-board bill of lading is a document that confirms that the goods have been loaded onto the shipping vessel.

- Certificate of Origin: A certificate of origin is a document that confirms the place of origin of the goods being shipped.

- Payment Documents: Payment documents, such as a draft or a wire transfer, provide evidence of payment under the letter of credit.

It is important to carefully review the requirements of the bank and the terms of the letter of credit, as additional documents may be required and the required documents may vary depending on the specific terms of the transaction and the type of letter of credit.

FAQ | what is a letter of credit and how does it work ?

how much does a Letter of credit cost ?

The cost of a letter of credit can go from a few hundred dollars to several thousands of dollars depending on the terms and conditions of the letter of credit. It is determined by various factors, including the amount, currency, issuing and advising bank costs, and additional fees like shipping, inspection, and other transaction-related fees.

What are the disadvantages of Letter of Credit ?

There are several disadvantages to consider when using à letter of credit such as its complexity of setting up, its price that can be very high, the time constraints and of course there is always the risk of fraud.

Is the Letter of Credit mandatory ?

No, the use of a letter of credit is not mandatory, it is à form of payment among many other forms that buyers and sellers can choose to use depending on their specific needs and circumstances.

What happens if the Letter of Credit expires ?

If a letter of credit expires, it will no longer be valid and can not be used to secure payment in an international trade deal. In some cases, the seller may be able to renegotiate the terms of the letter of credit and extend the expiration date. In other cases, the seller may have to seek payment through other means.

DocShipper info: Do you like our article today? For your business interest, you may like the following useful articles :

DocShipper Advise : We help you with the entire sourcing process so don't hesitate to contact us if you have any questions!

- Having trouble finding the appropriate product? Enjoy our sourcing services, we directly find the right suppliers for you!

- You don't trust your supplier? Ask our experts to do quality control to guarantee the condition of your goods!

- Do you need help with the logistics? Our international freight department supports you with door to door services!

- You don't want to handle distribution? Our 3PL department will handle the storage, order fulfillment, and last-mile delivery!

DocShipper | Your dedicated freight forwarder in Malaysia !

Due to our attractive pricing, many customers trust our services and we thanks them. Stop overpaying the services and save money with our tailored package matching will all type of shipment, from small volume to full container, let us find the best and cost-effective solution.

Communication is important, which is why we strive to discuss in the most suitable way for you!